Bitcoin’s four-year cycle, historically tied to halving events, has traditionally seen rapid gains followed by major corrections, typically spanning roughly four years from peak to peak.

Some market watchers argue the cycle may not persist into 2026. U.S.-listed bitcoin ETFs have absorbed $57 billion in inflows, Strategy (MSTR) acts as a near-constant buyer, and early holders distributed bitcoin at unprecedented levels above $100,000. Additionally, 2025 ended as a down year, defying expectations for a parabolic peak.

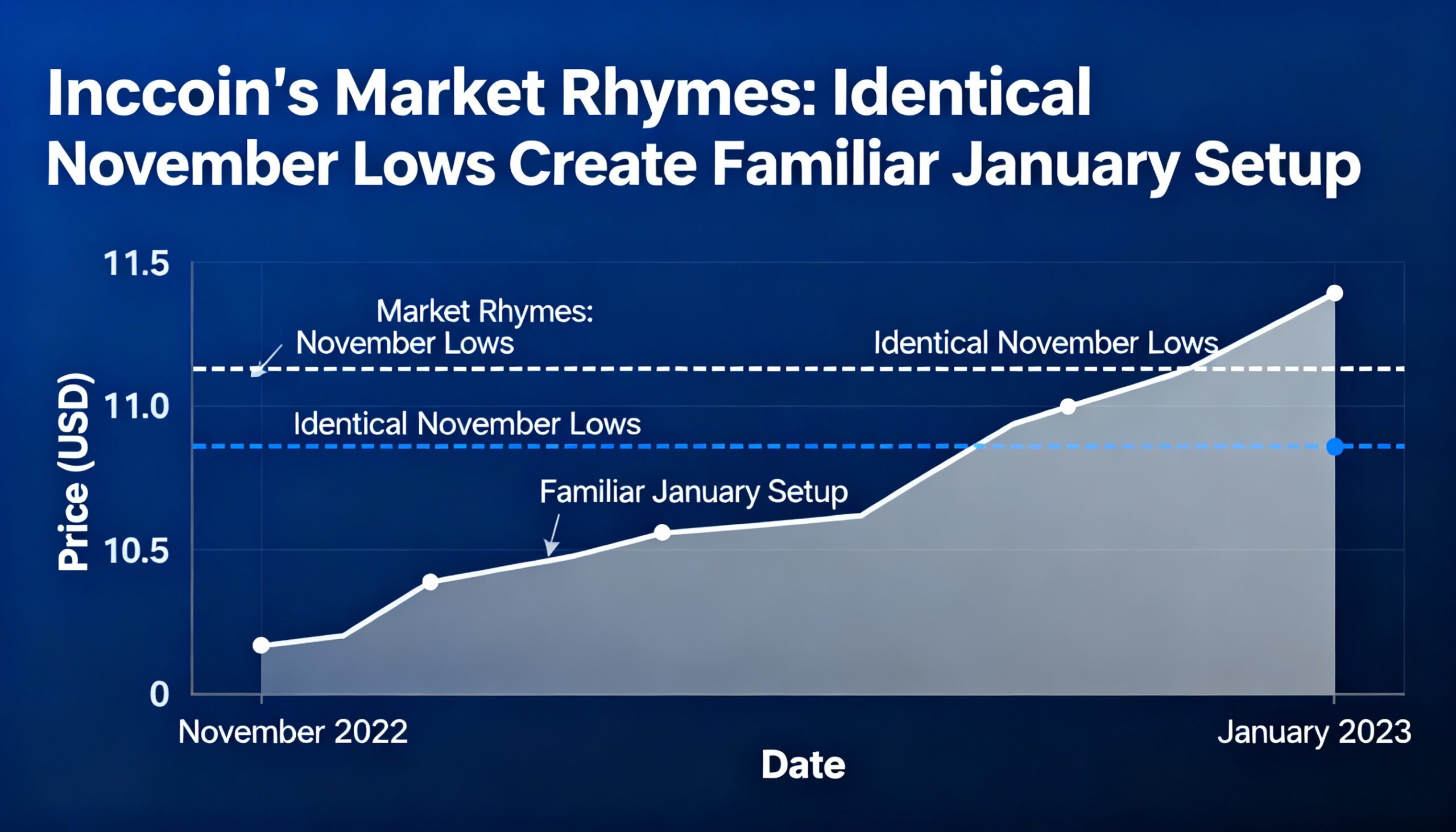

Yet the cycle shows signs of staying intact. Bitcoin peaked roughly 18 months after the April 2024 halving and reached $126,000 in October 2025, rebounding strongly from the $15,500 cycle low during the FTX collapse in November 2022. The local bottom on Nov. 21, 2025, at $80,524 mirrors the prior cycle low on Nov. 21, 2022, at $15,460, underscoring the pattern’s persistence.

January has historically been pivotal. January 2023 saw a local top near $25,000 before a drop below $20,000; January 2024 coincided with U.S. spot bitcoin ETF launches and a low under $40,000; and January 2025 aligned with President Trump’s inauguration and a local high near $110,000.

Now attention turns to January 2026. With a U.S. crypto market structure bill scheduled for a Jan. 15 markup hearing, the month could mark another meaningful inflection point, potentially signaling a top or bottom in bitcoin’s current cycle.