Silver extended its historic gains, climbing above $101 per ounce Friday after earlier topping $100 for the first time, while gold traded just below $5,000.

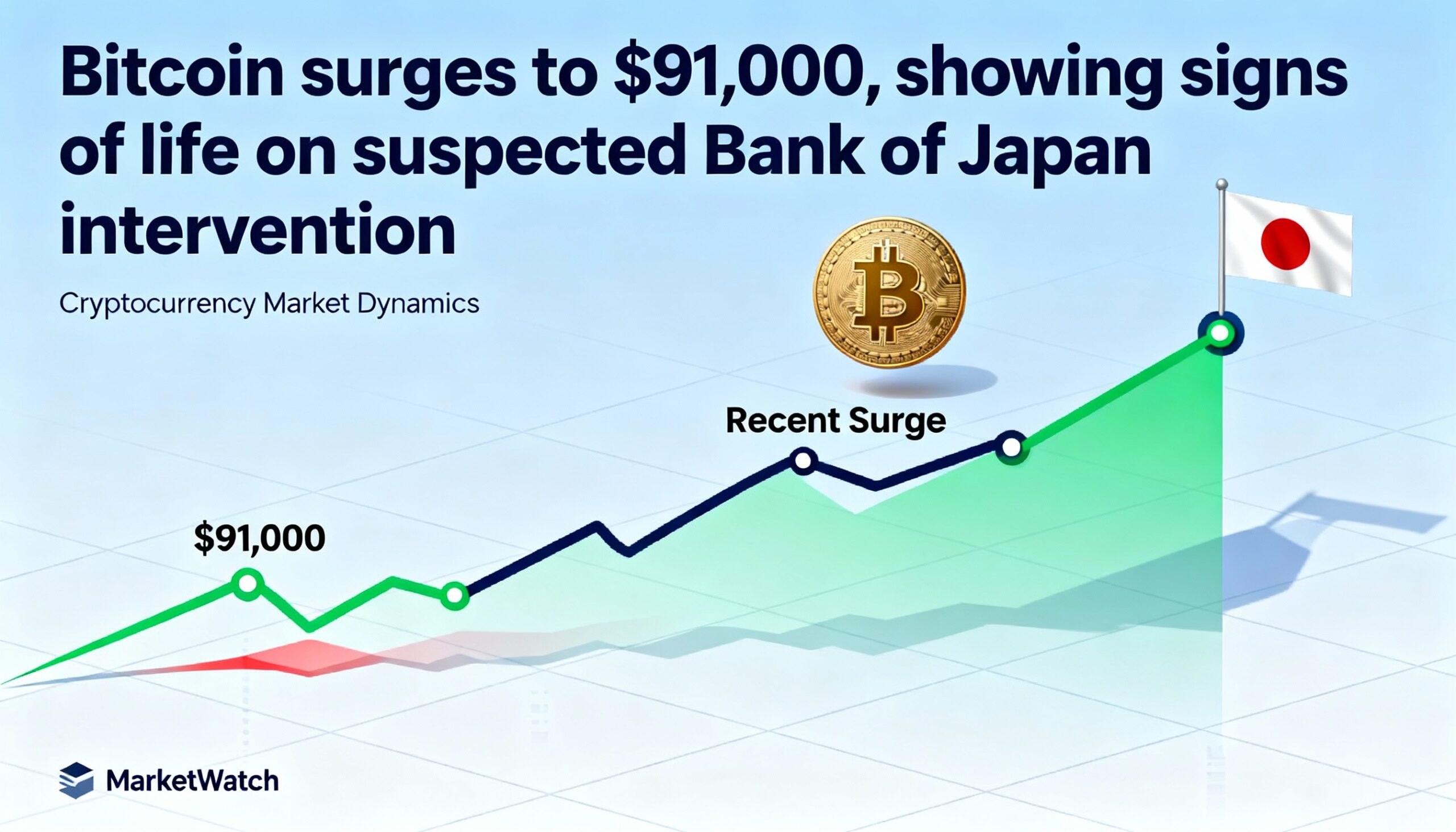

Bitcoin (BTC $87,757.89) bounced back to $91,000 in early U.S. afternoon trading, testing a possible breakout from its week-long $88,000–$90,000 range. Traders link the roughly 2% rebound from morning lows to suspected intervention in the Japanese foreign exchange market.

The Bank of Japan left policy unchanged overnight but struck a slightly hawkish tone, strengthening the yen against the U.S. dollar. The sudden move accelerated around noon on the U.S. east coast, with some analysts seeing signs of FX intervention. Many traders say the yen’s prior weakness had pressured bitcoin and other risk assets, and a reversal could boost cryptocurrencies.

Crypto stocks rally

Bitcoin-related equities recovered early losses. Miners with AI exposure—including Iren (IREN), Hut 8 (HUT), TeraWulf (WULF), and CleanSpark (CLSK)—rose 5%–10%. Strategy (MSTR) gained 5%, while Coinbase (COIN) trimmed its decline to 1%.

U.S. equities also rebounded, with the Nasdaq up 0.6%.

Precious metals continue climb

Silver surged more than 5% to $101.44 per ounce, gold gained 1.5%, and platinum and palladium jumped over 6% each, highlighting strong demand for safe-haven assets amid ongoing market volatility.