Long-term bitcoin holders accelerate selling as price lags broader markets

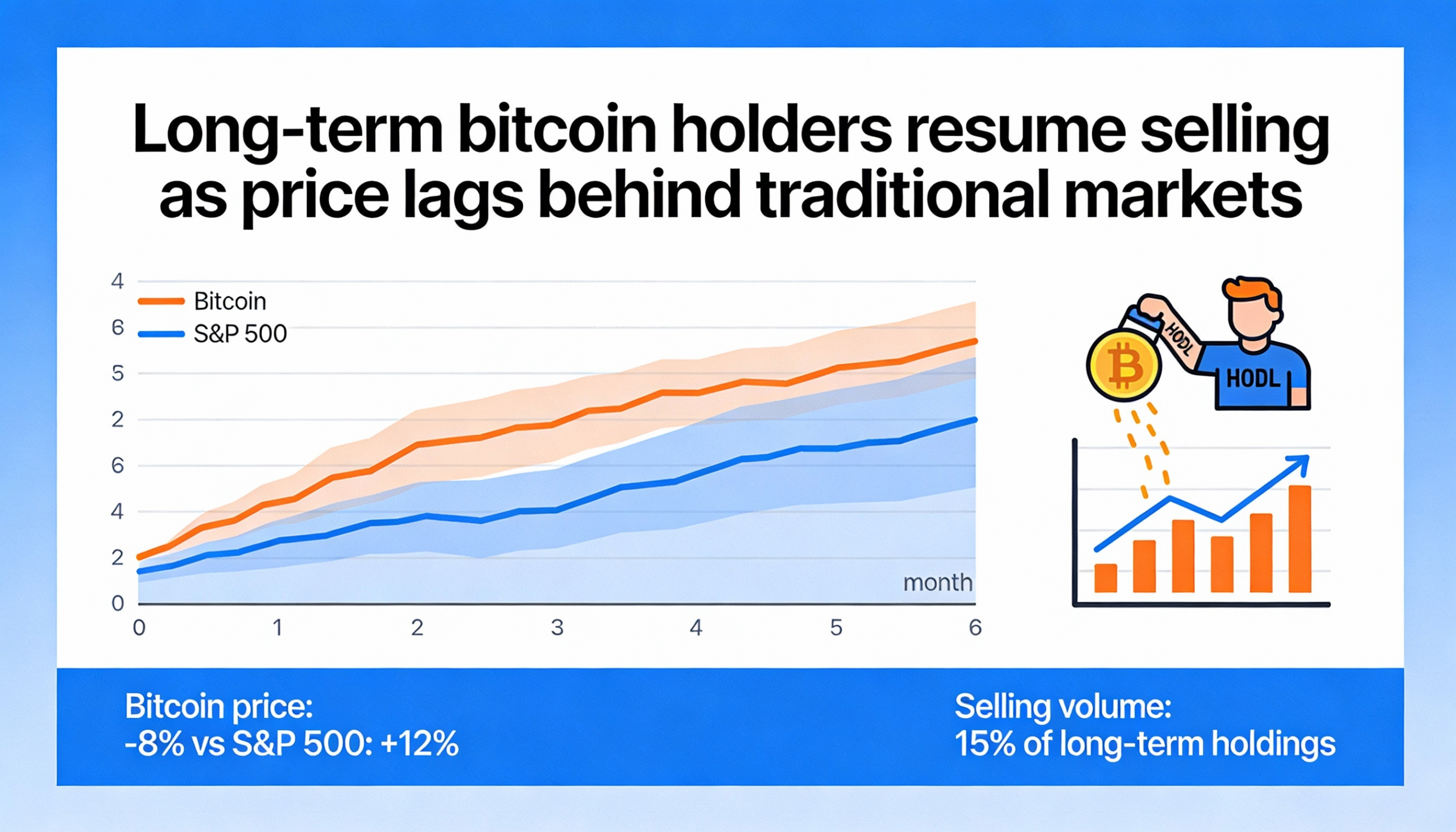

Long-term bitcoin holders are increasing sales at the fastest rate in five months as bitcoin continues to trail broader financial markets.

Investors who have held bitcoin (BTC $83,148.69) for at least 155 days—a cohort typically seen as the most conviction-driven—sold roughly 143,000 BTC over the past 30 days, according to Glassnode data. This mirrors the previous peak in August, when approximately 170,000 BTC were sold in a 30-day period ahead of bitcoin’s record high in October.

Bitcoin’s underperformance relative to traditional assets such as gold and silver, which are trading near record highs, points to stress in the crypto market and raises the potential for further downside or extended consolidation.

The October price peak coincided with a widely noted four-year cycle tied to bitcoin’s mining reward halving, which last occurred in April 2024. Historically, these cycles see a peak in the fourth quarter, followed by extended drawdowns and consolidation phases.

At the October top, nearly all long-term holders—about 15 million BTC—were in profit. Following a 36% drop through late November, long-term holders briefly returned to net accumulation from late December into early January, easing selling pressure temporarily and supporting a rally to around $97,000. Currently, roughly 2 million BTC are held at a loss.

Despite the recent uptick in sales, long-term holders still control about 14.5 million BTC, highlighting that reductions from this cohort remain a key factor weighing on bitcoin’s price in the near term.