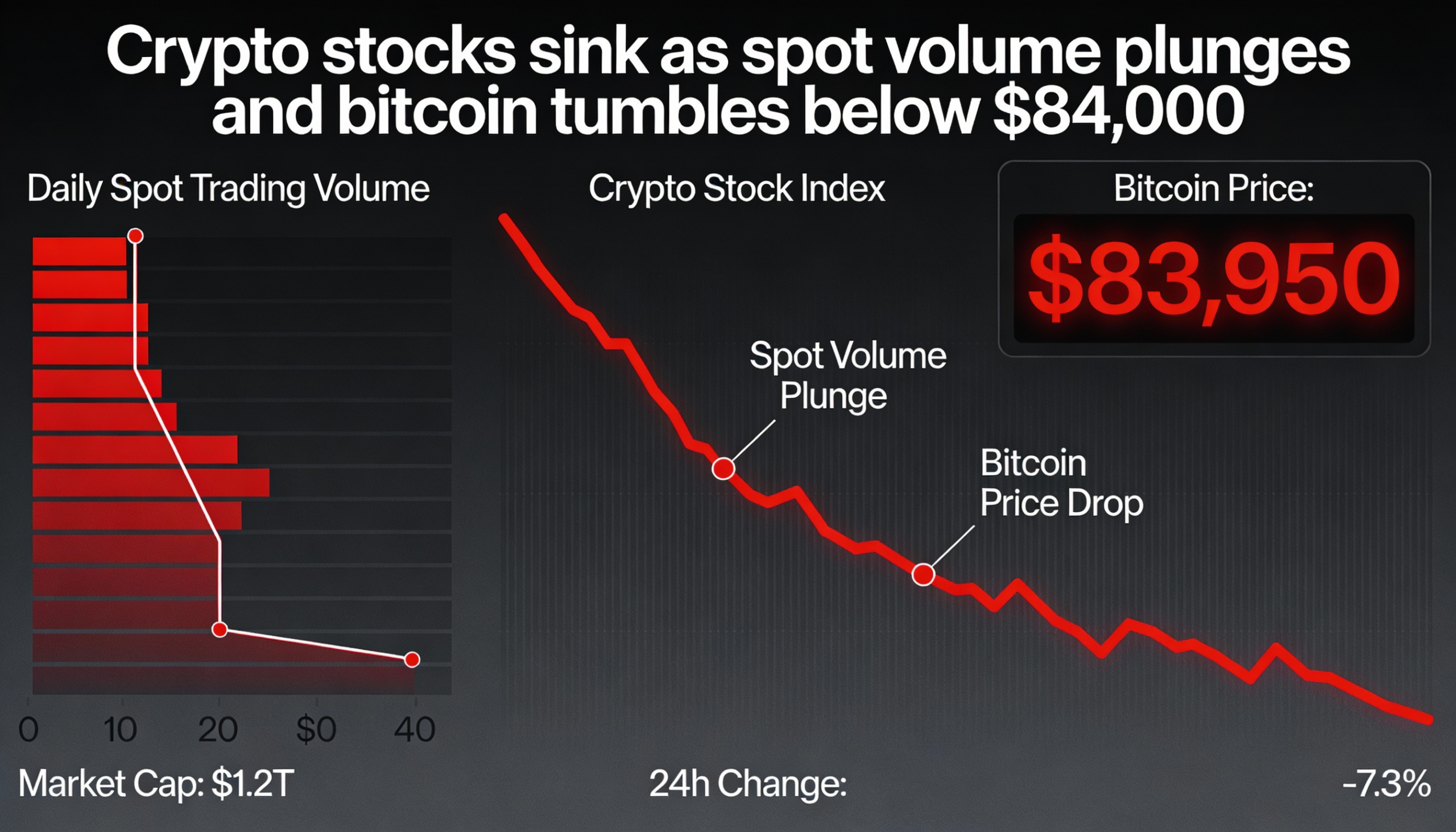

Crypto Exchange Stocks Slide as Bitcoin Drops Below $84K

Shares of major crypto exchanges extended losses on Thursday as Bitcoin fell 6% below $84,000, signaling caution across the market. Coinbase (COIN), the largest publicly traded crypto firm, declined 7% on the day and is down 17% year-to-date, marking its eighth consecutive losing session—its longest streak since September 2024. At $195, the stock has fallen back to May 2025 levels.

Other exchange stocks also fell sharply. Gemini (GEMI) lost 8% Thursday and 21% year-to-date, while Bullish (BLSH) and Circle (CRCL) are down 16% and 20%, respectively. The declines coincide with reduced spot trading volumes, which totaled $900 billion in January—roughly half the $1.7 trillion recorded a year earlier, according to TheTie.

“Bitcoin is hovering around $85,000, and investor hesitation is clear amid rising geopolitical tensions,” said Eric He, Community Angel Officer and Risk Control Adviser at LBank. “Crypto remains in a wait-and-see mode even as other asset classes advance.”

AI Diversification Supports Some Firms

Some crypto companies have fared better by pivoting toward AI. Bitcoin miners leveraging computing and energy resources for AI workloads—including Hut 8 (HUT), IREN (IREN), CleanSpark (CLSK), and Cipher Mining (CIFR)—are posting year-to-date gains.

Galaxy Digital (GLXY), led by Mike Novogratz, has also benefited from expanding into data centers, posting strong 2026 performance despite Thursday’s market pullback.