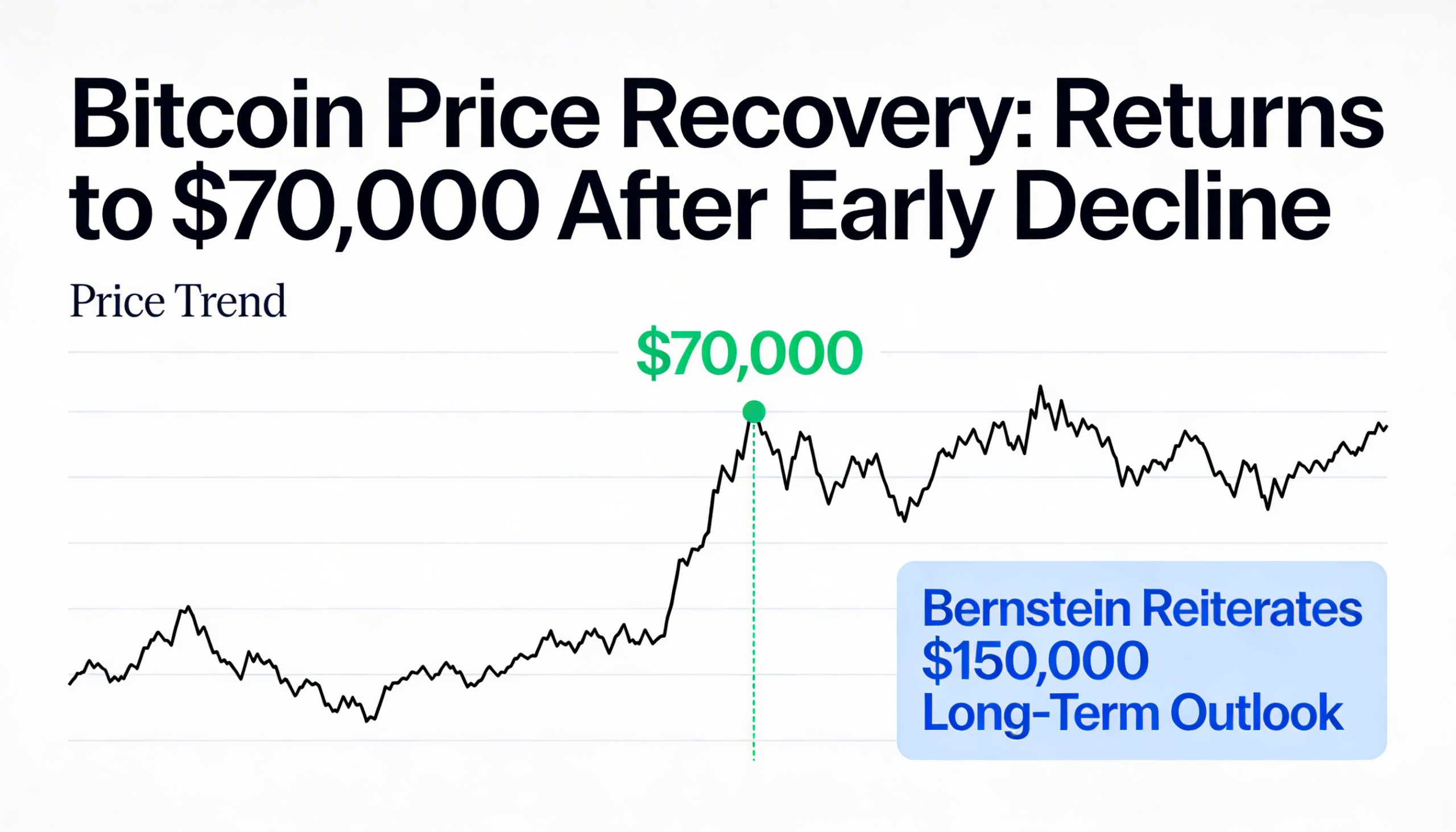

Bitcoin Rebounds to $70,800 as Bernstein Reiterates $150K Price Target

Bitcoin (BTC) climbed back above $70,000 during U.S. trading hours, reversing an earlier drop to just over $68,000. The recovery leaves the asset up approximately 0.5% over the past 24 hours.

Altcoins outperformed modestly, with ether (ETH), XRP and solana (SOL) each advancing around 1.5% on the day.

The broader risk environment was constructive. The Nasdaq gained 1%, while the S&P 500 rose 0.5%. Precious metals also posted strong moves, with gold up 1.9% to $5,075 per ounce and silver jumping 7.4% to $82.50.

Bernstein analyst Gautam Chhugani characterized the recent weakness as sentiment-driven rather than structural, calling it “the weakest bitcoin bear case in its history.” He reaffirmed the firm’s $150,000 year-end target, arguing that no fundamental breakdown has emerged to justify sustained pessimism.

“When all stars are aligned, the Bitcoin community manufactures a self-imposed crisis of confidence,” Chhugani wrote, adding that recurring cycles of doubt are a familiar feature of bitcoin’s history.

Technical signals from the mining sector may also point to stabilization. Schwab analyst Jim Ferraioli noted that bitcoin has historically found support near its production cost. As prices fall toward that threshold, less efficient miners often curtail operations, leading to a decline in network difficulty.

That dynamic is now visible. Mining difficulty recently recorded its largest drop since 2021, reflecting some miner capitulation amid lower prices. Ferraioli said a renewed increase in difficulty could serve as confirmation that the market has found a bottom.

Crypto-linked equities advanced alongside the rebound in digital assets. Bullish (BLSH) surged 14.2%, Galaxy Digital (GLXY) rose 8.2%, and Circle (CRCL) gained 5.1%. Strategy (MSTR) climbed 3%, while Coinbase (COIN) added 1%.

Bitcoin miners pivoting toward AI infrastructure also rallied after Morgan Stanley initiated positive coverage on TeraWulf (WULF) and Cipher Mining (CIFR), both up roughly 14%. Hut 8 (HUT), IREN (IREN) and Bitfarms (BITF) each rose about 7%.