Trump’s Tariff Pause Sparks Crypto Comeback as SOL, DOGE Take the Lead

After a shaky Thursday across both traditional and crypto markets, Friday brought a breath of relief — and a surge in price action — following President Trump’s surprise 90-day freeze on new tariffs (with China notably left out of the pause).

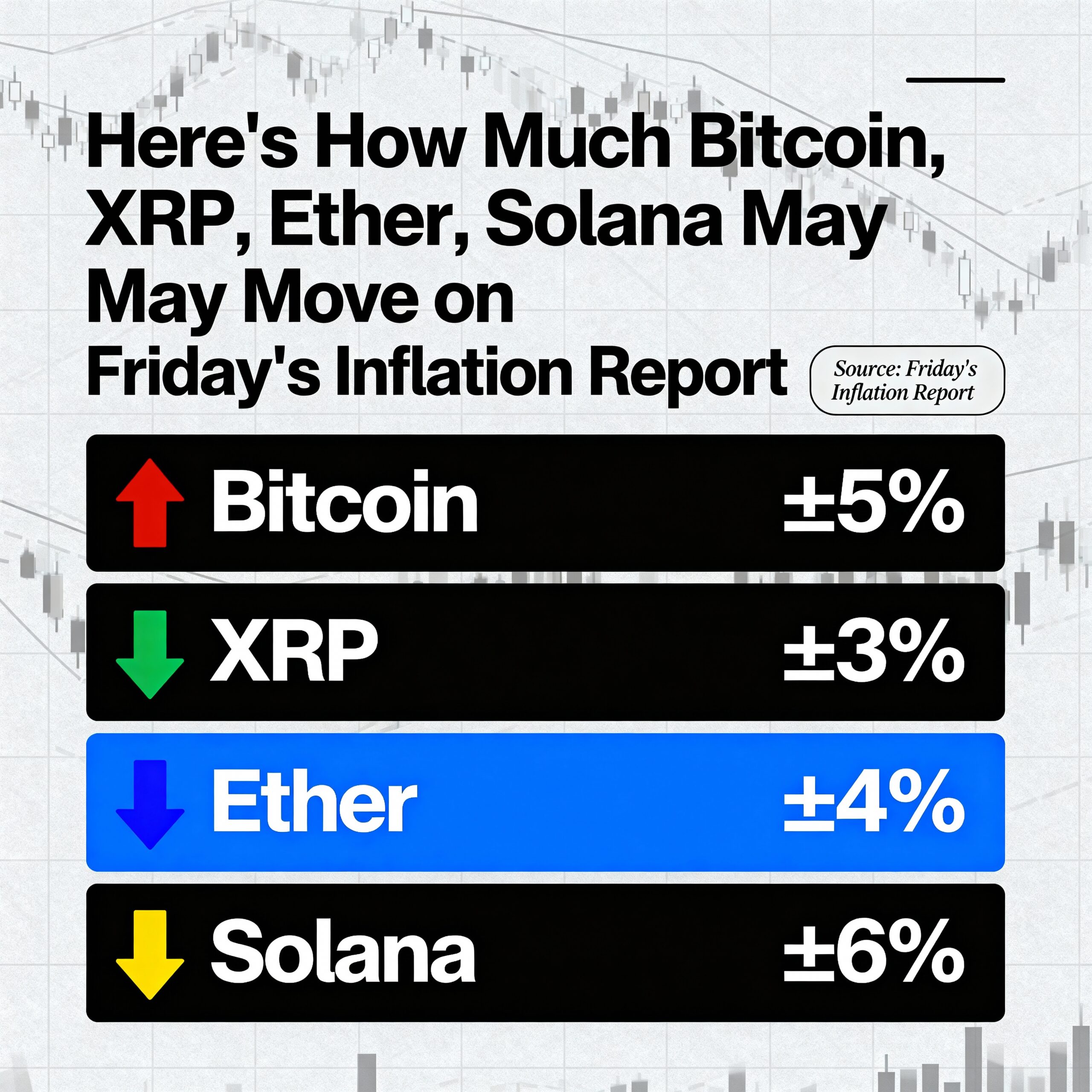

Bitcoin (BTC) and major altcoins bounced back sharply, led by standout gains in Solana (SOL) and Dogecoin (DOGE), which rallied more than 4% in the last 24 hours. XRP, BNB, and TRX weren’t far behind, posting solid 2%-3% increases. Ethereum (ETH), however, continued its slump, down another 2.4% — capping off a rough week with a 12% total decline.

Markets initially celebrated the news with a strong risk rally, only to pull back Thursday before rallying again into the weekend. The back-and-forth reflects the current tug-of-war between macro fear and technical positioning.

“The policy shift provided a temporary volatility reprieve,” one trader said, noting that short-term implied volatility in crypto dipped, and long-dated bitcoin call options — particularly the $100K strikes for December — gained traction.

Ming Wu, CEO of RabbitX, likened the market reaction to a “sharp pivot.” Speaking to CoinDesk via Telegram, he said, “This announcement shifted the tone dramatically. The pause gave traders breathing room while still signaling toughness toward China — that’s a complex but bullish combo.”

Wu also pointed to technical factors at play. “Markets were oversold heading into the news. This was a textbook short squeeze off major support levels.”

Meanwhile, Ryan Lee, Head Analyst at Bitget Research, noted bitcoin’s 6% rally off the lows, reclaiming $80,000 with authority. “BTC jumped quickly after the announcement, and institutions appear to be active buyers again. We’re seeing renewed positioning from long-term holders, who view BTC as a reliable macro hedge.”

Lee emphasized the importance of the $80K level in the short term. “We expect a range between $80K and $85K over the coming days. If macro uncertainty fades, bulls could target $85K+. If volatility returns, we could see a dip to $78K.”

As the dust settles from the latest macro policy twist, traders are closely watching for further developments in U.S.-China trade tensions — and whether Friday’s crypto strength signals the start of something bigger.