Andreessen Horowitz Expands Investment in LayerZero’s ZRO Token with $55M Purchase, Strengthening Cross-Chain Infrastructure

LayerZero’s native token (ZRO) spiked in value on Thursday after news broke that venture capital firm Andreessen Horowitz (a16z) had significantly increased its investment in the blockchain interoperability protocol.

The firm acquired an additional $55 million worth of ZRO tokens, locking them up for a three-year period, according to Ali Yahya, general partner at a16z, who shared the details in a post on X. This latest investment follows Andreessen Horowitz’s earlier backing of LayerZero Labs, the team behind the protocol, which saw participation in both the $135 million Series A funding round in 2022 and the $120 million Series B round in 2023.

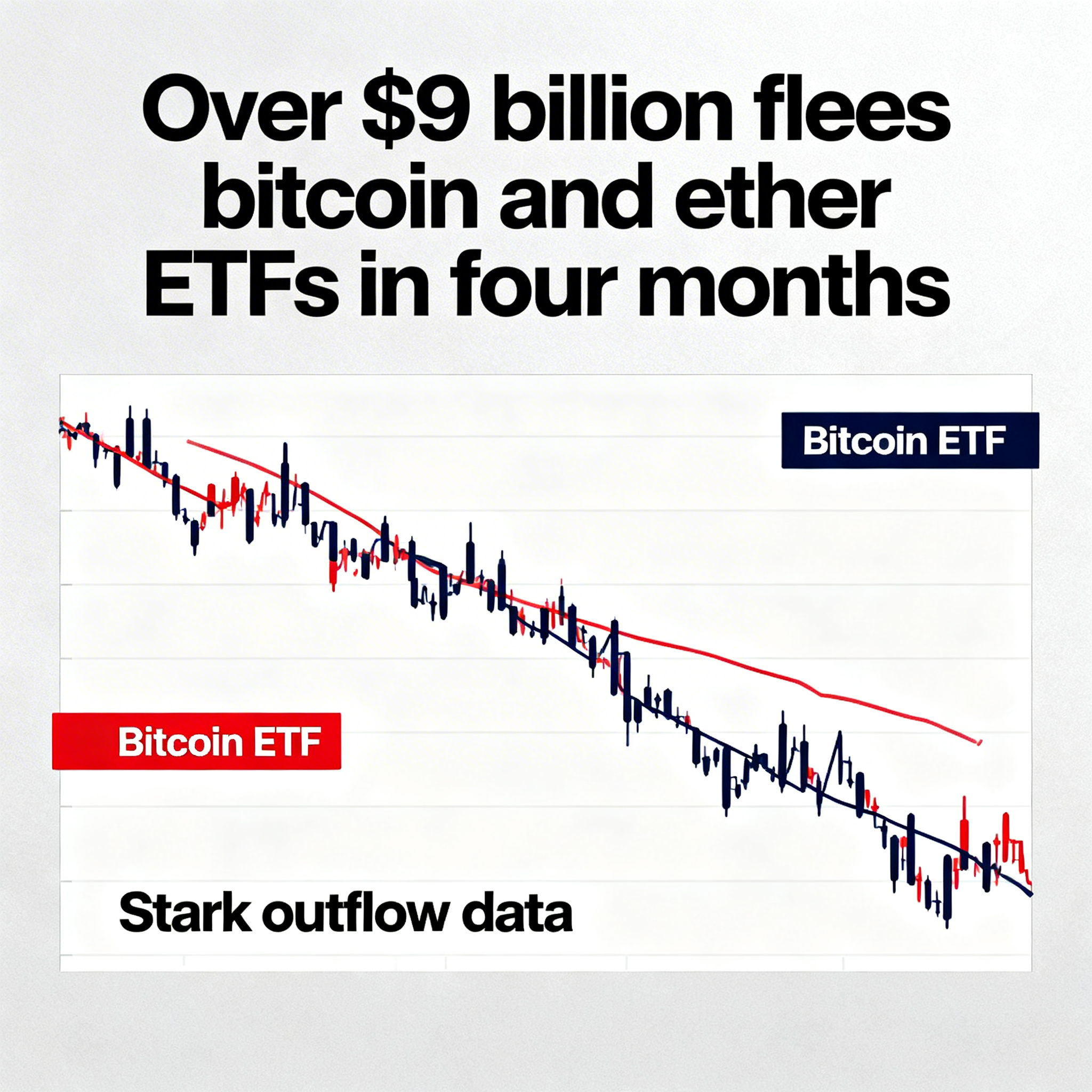

ZRO’s price surged by 10%, briefly reaching $2.56, before retracing slightly. Even so, it maintained a 5% gain on the day, outperforming the broader CoinDesk 20 Index and Bitcoin (BTC).

LayerZero is a key player in the blockchain space, enabling different blockchains to communicate through cross-chain messages. It currently supports 125 blockchains and has processed over 145 million cross-chain messages, moving a total of $75 billion in value. LayerZero’s technology underpins major projects such as PayPal’s stablecoin, DeFi platforms Ethena and Pendle, and was chosen for Wyoming’s state-backed stablecoin initiative.

The recent funding will help LayerZero expand its capabilities beyond interoperability, focusing on token issuance, data management, governance, and improving database infrastructure, according to company statements.