Bitcoin’s Pullback Signals Deleveraging, Not an Altcoin Surge

Bitcoin (BTC $84,392.84) has faced a sharp decline this month, with its market dominance—the share of BTC’s market capitalization relative to the broader crypto market—also slipping. While a falling dominance is often seen as a sign that investors are rotating into altcoins, fueling speculation of an imminent “alt season,” analysts caution that the current trend reflects a broader market reset rather than a simple BTC-to-alt rotation.

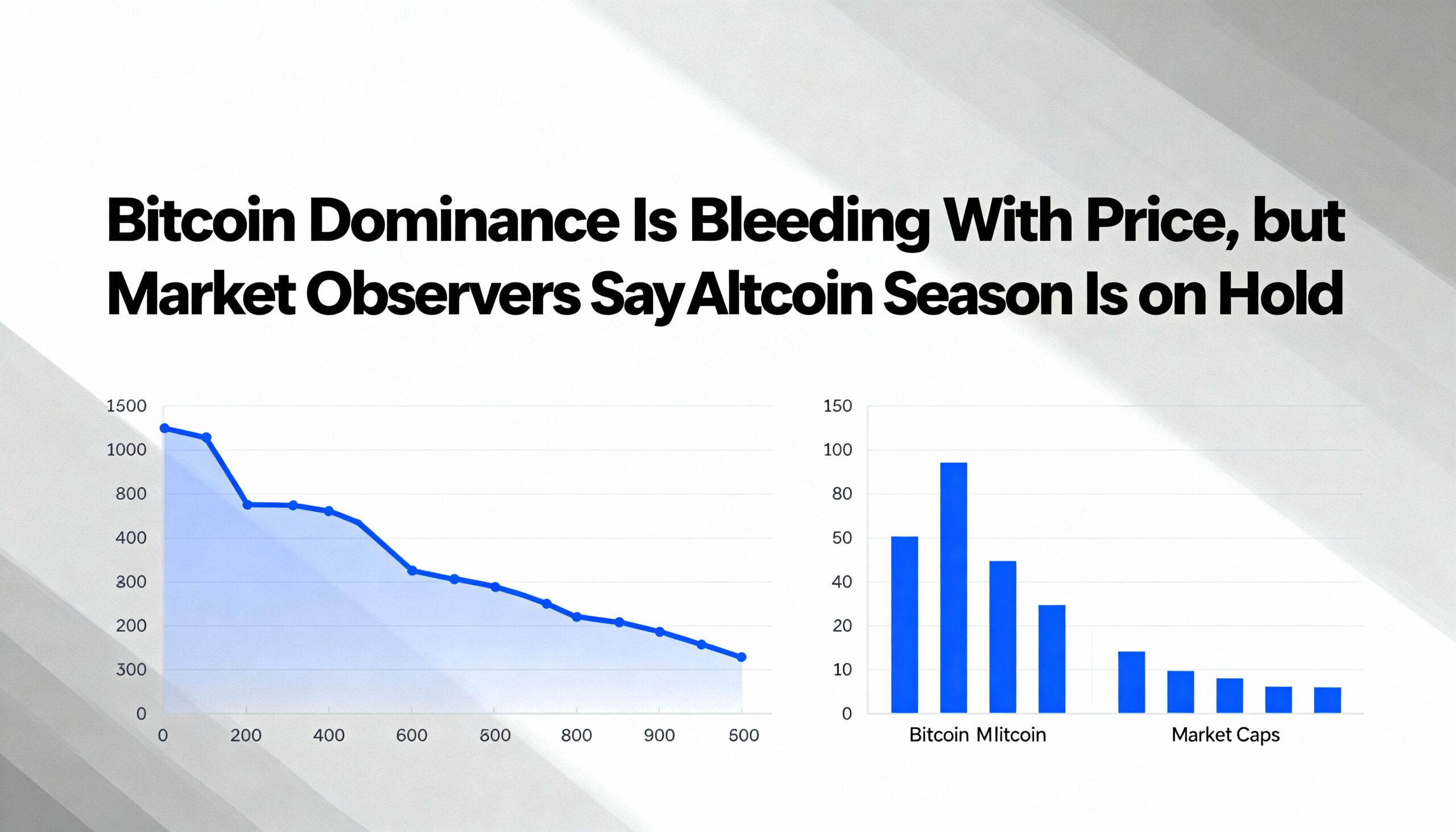

Price trends, cross-pair performance, and on-chain activity all point to a steady deleveraging cycle rather than the early stages of an altcoin rally. Over the past month, BTC has fallen nearly 16%, with dominance declining from 61.4% to 58.9%, according to CoinDesk market data. Other major tokens, including Ethereum (ETH $2,741.79), Cardano (ADA $0.3976), Dogecoin (DOGE $0.1384), and Solana (SOL $126.63), have experienced even sharper losses.

Some pairs show selective resilience. XRP/BTC has demonstrated notable strength, while ETH/BTC has declined only modestly, highlighting targeted stability rather than a widespread shift in market leadership. Analysts attribute these movements to the market absorbing excess leverage following October’s liquidation events, rather than signaling a risk-on rotation into altcoins.

“Bitcoin’s drawdown this month reflects a general deleveraging that began with October’s liquidation. Since then, the market has been grinding lower as leverage is flushed out,” Rohit Apte, Head of Markets at Hex Trust, told CoinDesk in a Telegram interview.

Apte emphasized that an altcoin season is not yet underway. Most altcoins have underperformed BTC and ETH on a relative basis. “For any sustainable rotation into alts, we would first need to see the majors stabilize and establish a price consolidation,” he said.

On-chain metrics support this view. Data from Blockscout show that Ethereum’s ecosystem remains active but not overheated. Base is currently the hotspot, processing roughly 19 million daily transactions and seeing increased token creation via Coinbase’s Launchpad and Smart Wallet tools. Other major networks—including Optimism, Arbitrum, Polygon, and Celo—are stable, handling millions of daily transactions without a surge in fees.

This environment suggests that the market is neither in distress nor entering the speculative frenzy that typically sparks an altcoin cycle. Historically, true altcoin seasons coincide with rising network fees, congestion, and a broad jump in activity across multiple chains.

Currently, traders appear to be reducing exposure without aggressively moving into higher-beta assets, signaling a cautious sentiment. Until BTC and ETH find firmer footing and consolidate their ranges, the market is likely to drift sideways rather than enter the momentum-driven environment characteristic of an altcoin season.