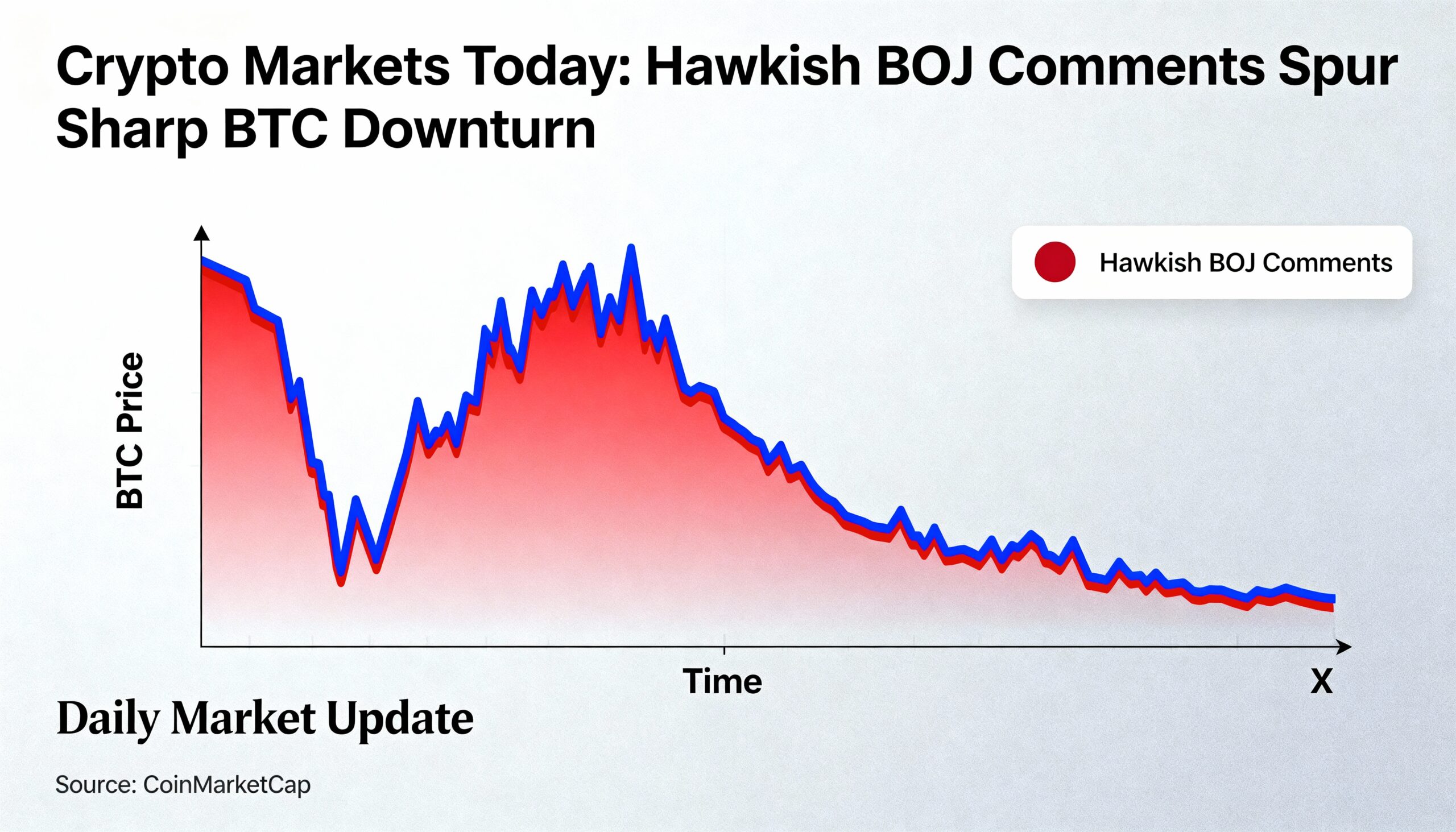

Crypto markets fell sharply on Monday, with bitcoin leading the decline following a sell-off that hit minutes after the CME bitcoin futures market reopened. The CoinDesk 20 Index dropped nearly 6% in 24 hours as investor caution intensified.

The rout reflects ongoing liquidity challenges in crypto markets, which remain fragile after October’s $19 billion liquidation wave. Market jitters were compounded by comments from Bank of Japan Governor Kazuo Ueda, who hinted at a potential interest-rate hike this month. Yields on Japan’s 30-, 10-, and 2-year government bonds surged to levels not seen since 2008. A stronger yen could prompt hedge funds that borrow in yen to invest in risk assets, including bitcoin, to adjust their positions, further pressuring prices.

Derivatives and volatility

- Crypto futures saw significant outflows, with open interest in ZEC, SUI, UNI, and ENA falling over 10% in 24 hours.

- Bitcoin’s open interest declined 2%, while ether’s rose slightly to 12.51 million ETH, its highest since Nov. 21, hinting at increased short positions.

- Funding rates turned deeply negative across SOL, BBB, XRP, AVAX, and DOT (-7% to -11% annualized), reflecting a bearish market bias.

- Volmex’s 30-day bitcoin implied volatility index (BVIV) spiked above 55% before easing to 53%, signaling heightened fear.

- Put skews strengthened in short- and near-dated BTC and ETH options on Deribit.

- Block trades included BTC strangles and ETH straddles, indicating traders are positioning for increased volatility.

Altcoin market under pressure

Altcoins were hit harder than major coins. ZEC dropped 20%, ENA fell 16%, and TIA slid 14% over 24 hours. Of $637 million in total liquidations, more than $430 million came from altcoins, many extending downtrends that began in early October.

The market is approaching a critical technical threshold. A break below November lows could confirm a broader bearish reversal from October highs. However, the average RSI indicates oversold conditions, suggesting a potential relief rally as short sellers take profits.

A few tokens bucked the downtrend. Layer-1 token KAS rose 29% over the past week, while SKY (formerly MKR) climbed 17% following buyback announcements. Despite these pockets of strength, the altcoin season index remains at 24/100, down from September’s 78/100, highlighting investor preference for bitcoin’s liquidity and relative stability during turbulent market conditions.