Crypto Modestly Rebounds as Inflation Data Meets Expectations, But Fear Lingers – 27/9/2025

Crypto markets saw a modest recovery on Friday, with Bitcoin climbing back above $110,000 to $113,012.67 and Ethereum outperforming with a 3.8% gain to $4,107.93. Dogecoin rose 3.4% to $0.2271, while Solana added 2.5% to $205.44.

The cautious buying followed the release of U.S. inflation data, which came in line with expectations. The Federal Reserve’s preferred gauge, the Personal Consumption Expenditures (PCE) index, rose 2.7% year-over-year in August, while core PCE, excluding food and energy, increased 2.9%.

Fabian Dori, CIO at Sygnum Bank, said the report underscores the Fed’s narrative of gradually easing price pressures but leaves policymakers balancing sticky inflation against a softer labor market. “For investors, the implications are twofold: declining inflation could support risk assets through confidence in the Fed’s easing cycle. But any upside surprises in upcoming data could delay rate cuts, weighing on equities and strengthening the U.S. dollar,” Dori noted.

Crypto Sentiment Remains Fragile

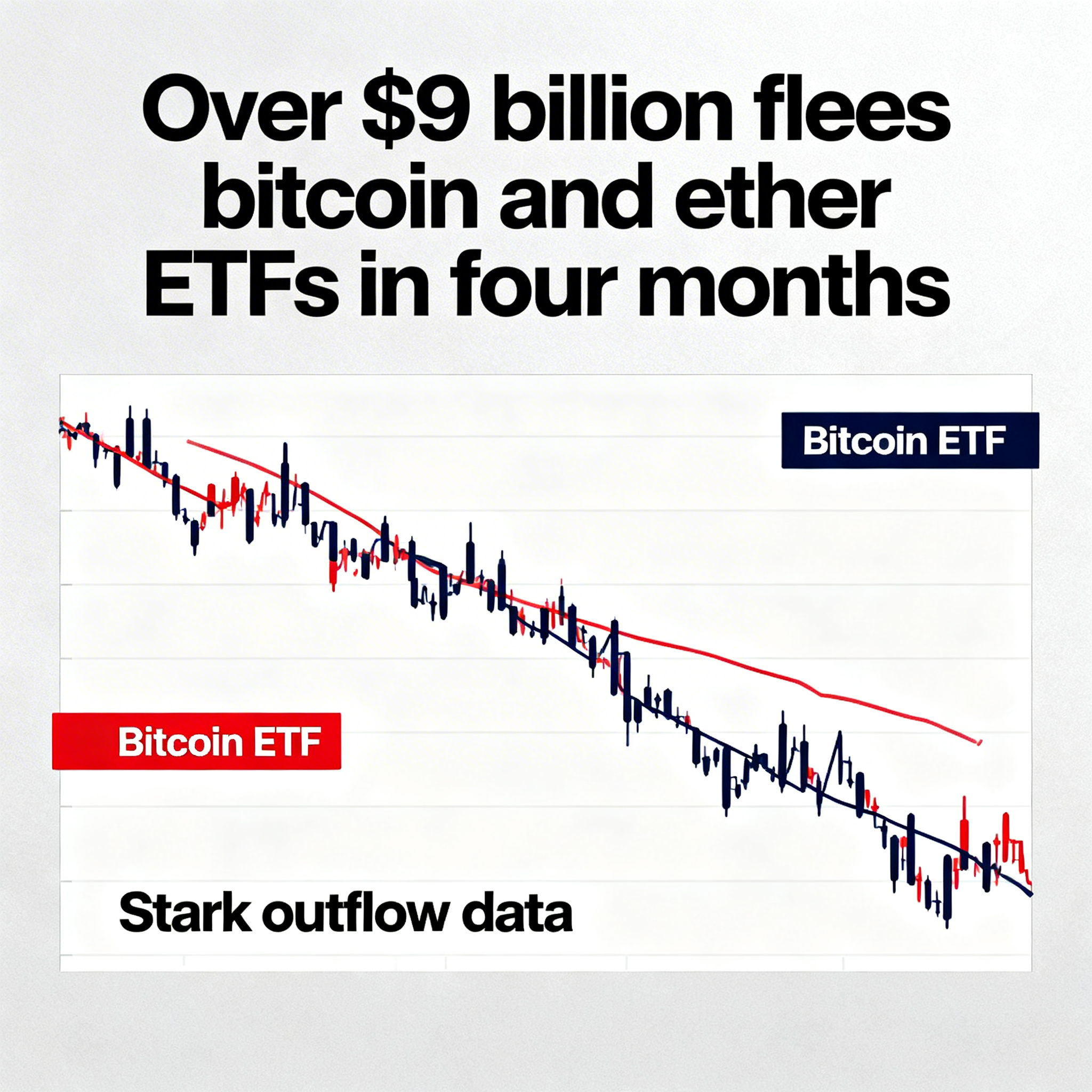

Despite the rebound, market sentiment remains cautious. The Fear & Greed Index fell to 28 on Friday, its lowest level since mid-April, signaling “fear” among traders. The drop follows a $1.1 billion liquidation wave on Thursday that wiped out leveraged long positions.

Matt Mena, strategist at digital asset manager 21Shares, highlighted that roughly $3 billion of leveraged longs have been liquidated in recent days. “Excess leverage has largely been flushed out, leaving positioning extremely bearish. Popular tokens such as BTC, SOL, and DOGE now show a long-to-short ratio of just one-to-nine,” Mena said. He added that the setup could create conditions for a potential short squeeze.

However, not all analysts are optimistic. Paul Howard, senior director at trading firm Wincent, cautioned that crypto could drift lower before stabilizing. He pointed to BTC dipping below its 100-day moving average under $110,000 and the total crypto market cap falling below $4 trillion as signs of weakness. “The market is undergoing a healthy correction without panic or a major spike in volatility,” Howard said. “It is likely to grind lower in the coming weeks,” adding that he is questioning whether crypto will revisit 2025 record highs.