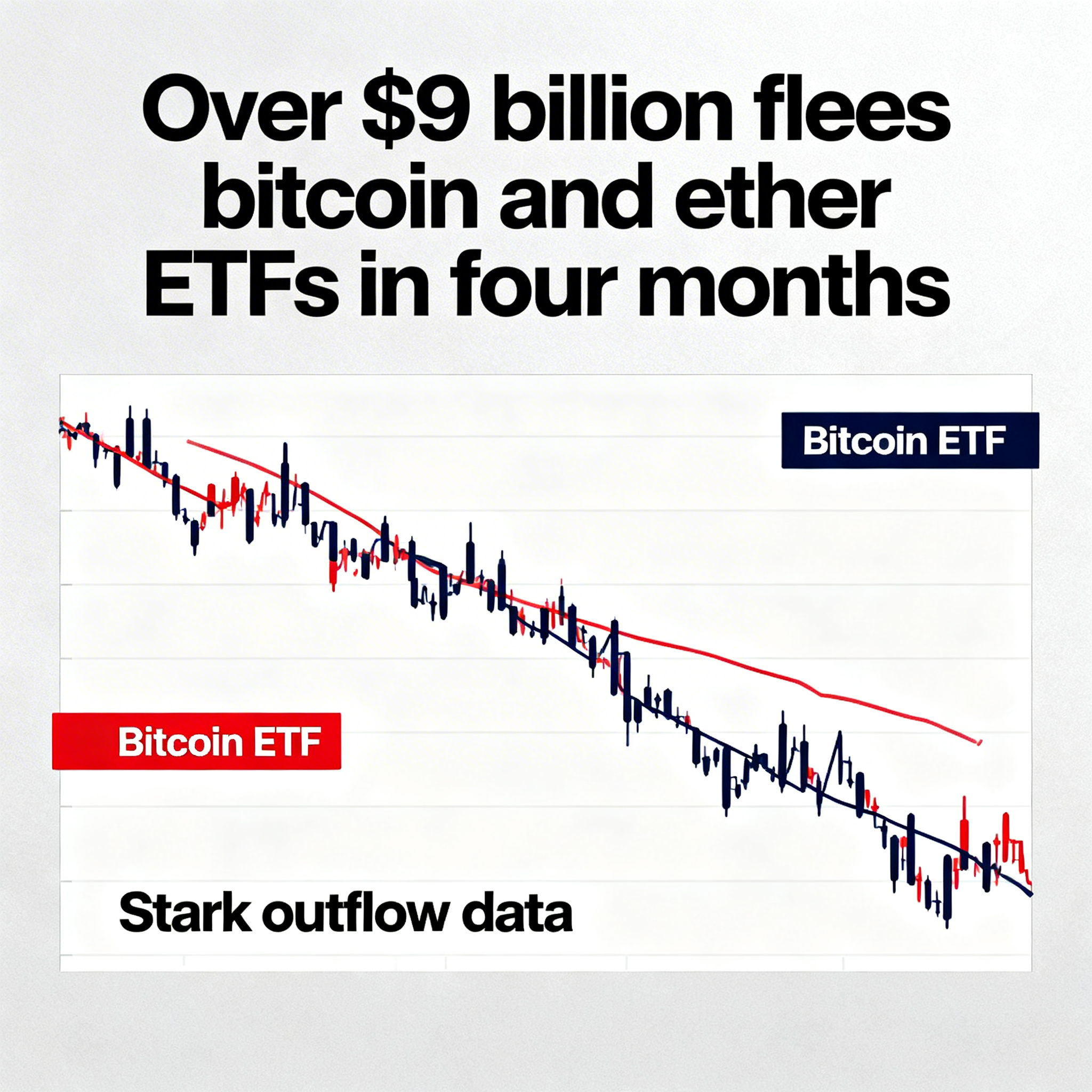

Bitcoin’s $2 Trillion Market Cap Fuels Surge of New Buyers, But Weak Momentum Signals Possible Price Stagnation

Bitcoin’s (BTC) market cap has now surpassed the $2 trillion mark, attracting a surge of new retail investors, yet signs of weak momentum from seasoned traders suggest the potential for price consolidation, according to Glassnode’s on-chain analysis.

After Bitcoin’s price broke through $100,000 last Thursday, its market capitalization climbed above $2 trillion, marking a significant milestone not seen since January 31, according to TradingView data. Since then, Bitcoin has held steady above this threshold, with market analysts predicting further price growth, fueled by the release of U.S. inflation data scheduled for later this week.

The current bullish market environment has enticed a wave of first-time investors, often driven by FOMO (fear of missing out), where they are buying into Bitcoin based on others’ gains or the fear of missing significant price increases. This behavior tends to drive impulsive buying and a short-term spike in prices.

“BTC Supply Mapping shows a consistent rise in demand from new buyers. The 30-day Relative Strength Index (RSI) for First-Time Buyers has remained at 100 throughout the week,” Glassnode noted in a post on X.

First-time buyers are defined as wallets that have purchased Bitcoin for the first time, and the consistent RSI of 100 suggests a strong influx of new capital entering the market.

However, while new buyers are eager, other investor segments are showing less enthusiasm, hinting at a potential slowdown in price momentum or a period of consolidation.

Glassnode’s data reveals that momentum buyers are underperforming, with their 30-day RSI at just 11. These traders typically capitalize on established trends, betting that a price movement will continue in a specific direction.

“Momentum Buyers continue to show weakness (RSI ~11), and there’s a rising number of Profit Takers. If fresh inflows slow down, the market may face consolidation as there is no strong follow-through,” Glassnode warned.