U.S. equities are also fading sharply from an early surge, with the Nasdaq now up just 0.3%.

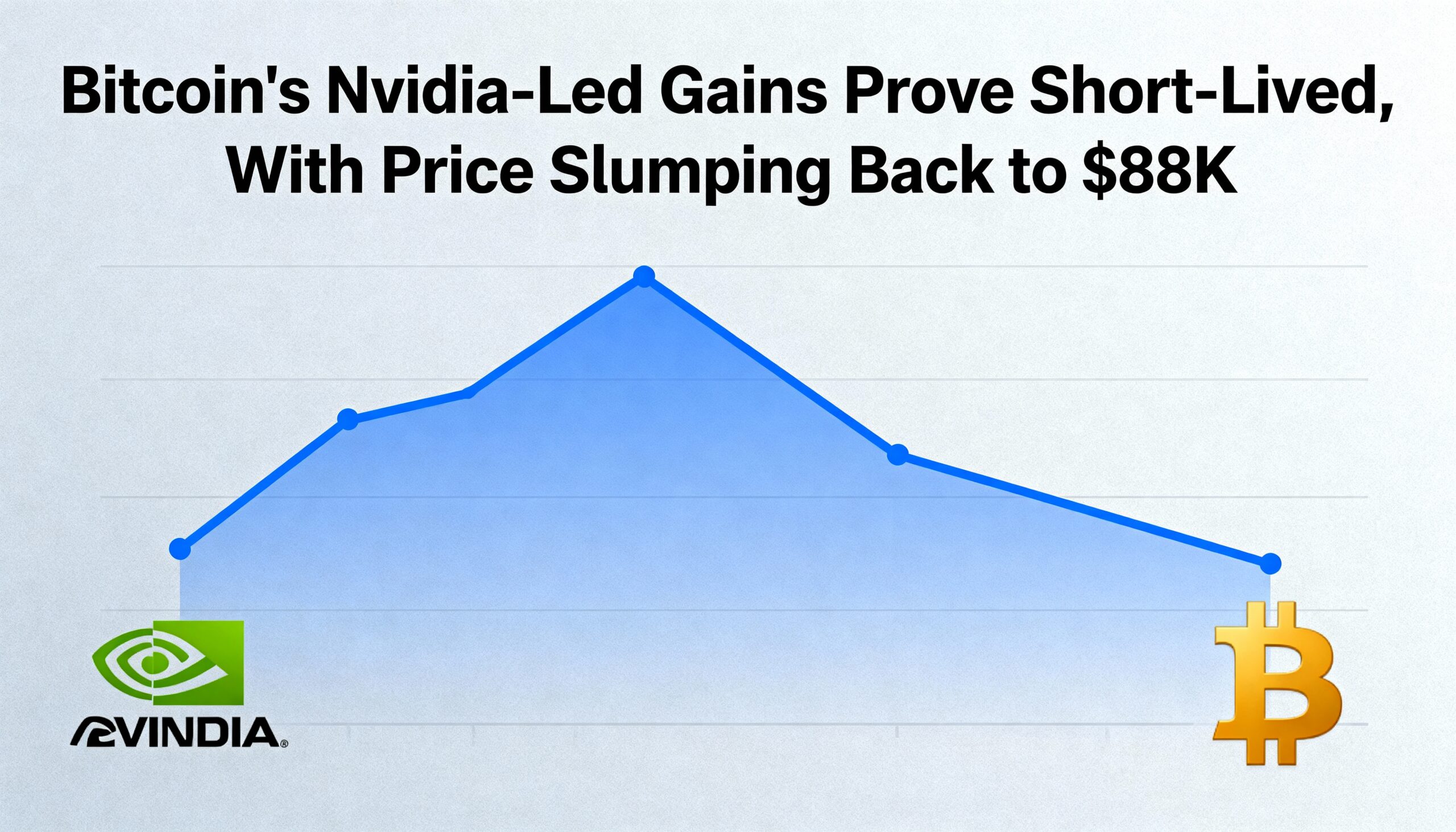

Crypto markets once again failed to hold onto modest gains Thursday, as selling pressure quickly erased bitcoin’s brief Nvidia-led rally. After climbing above $93,000 overnight, bitcoin (BTC) slid back to $88,000 as traders unwound positions into strength.

The move higher began late Wednesday after Nvidia (NVDA) reported strong earnings and delivered an upbeat outlook, calming market nerves and lifting risk assets broadly. The results initially pushed the Nasdaq more than 2% higher, while also fueling a short-lived bounce in crypto.

But those gains have largely evaporated. The Nasdaq is now barely positive at 0.3%, and Nvidia shares — up more than 5% earlier — have turned flat.

Macro sentiment remains fragile as investors increasingly conclude the Federal Reserve is unlikely to cut rates at its December meeting. Fresh labor data, delayed due to the government shutdown, showed nonfarm payrolls rising by a far stronger-than-expected 119,000 in September.

Adding to the hawkish tone, Cleveland Fed President Beth Hammack said persistent inflation and elevated equity valuations are not arguments for rate cuts — remarks that evoked memories of Alan Greenspan’s famous “irrational exuberance” warning in 1996, though markets rallied for years afterward.

Ether (ETH) came under even heavier pressure than bitcoin, dropping nearly 4% in the past hour. Sentiment may have been weighed down by digital asset treasury FG Nexus selling part of its crypto reserves to repurchase its stock, which has plunged more than 95% since the summer.

Crypto-related equities, which opened the day higher, have also reversed. MicroStrategy (MSTR) is down 4.7% and off 62% year-over-year, hitting a new 52-week low at $178. Coinbase (COIN) and Gemini (GEMI) have fallen 4% and 5%, respectively, while stablecoin issuer Circle (CRCL) is lower by 3.5%.