Leverage Meltdown: Trump-Musk Feud Triggers $1B Crypto Liquidation Cascade

A fiery social media standoff between former President Donald Trump and Tesla CEO Elon Musk sent shockwaves through the crypto market, triggering a violent sell-off that liquidated nearly $1 billion in leveraged positions across major digital assets.

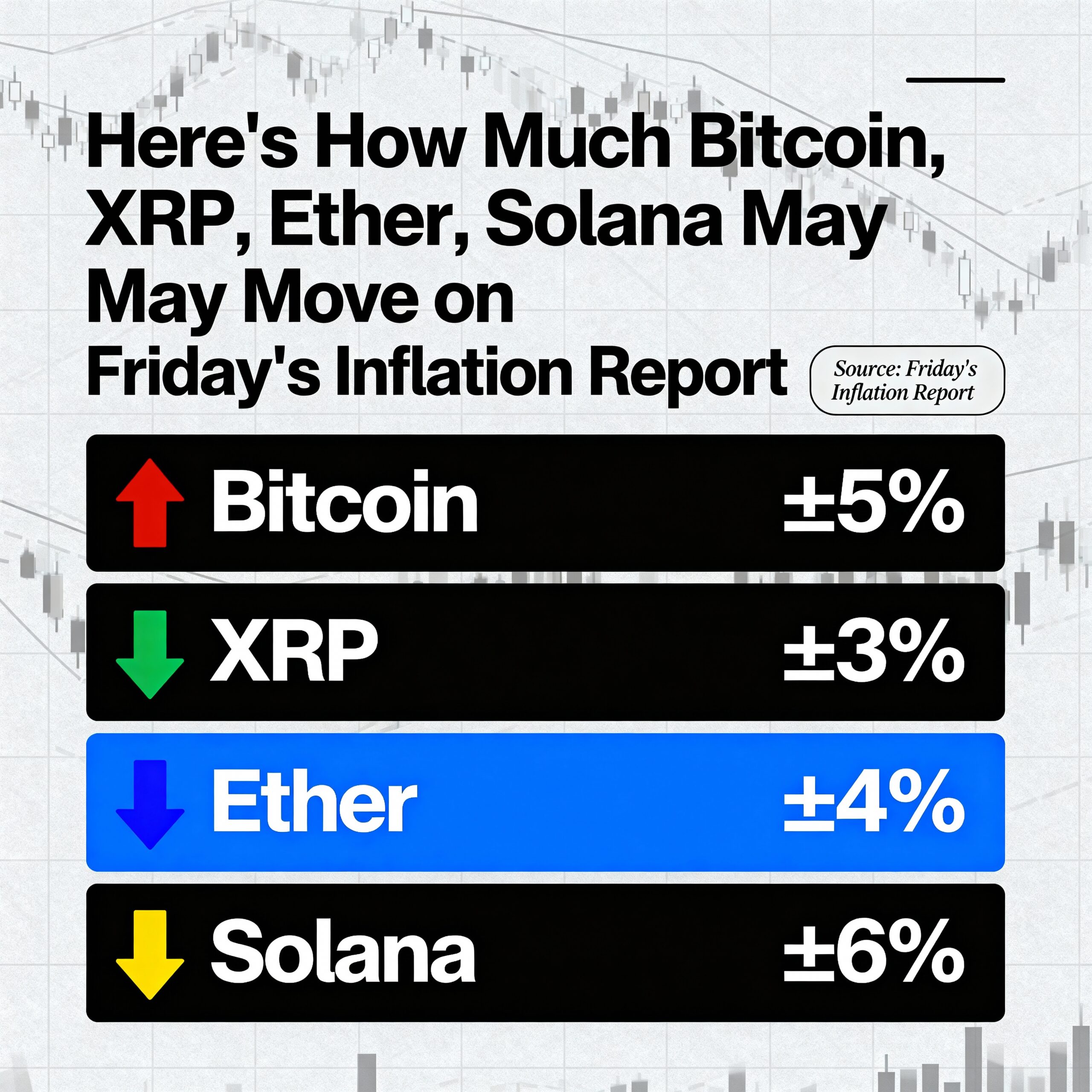

Bitcoin (BTC) briefly tumbled below $101K, while Ethereum (ETH) slid over 4%, as traders rushed to de-risk amid mounting political uncertainty. According to CoinGlass, over $988 million in positions were liquidated in the last 24 hours — $888 million of which were longs.

The bulk of the carnage hit:

- Bitcoin: $342M liquidated

- Ethereum: $286M

- Solana: $51M

- Dogecoin & XRP: Over $50M combined

- Memecoins like 1000PEPE: Extreme swings as retail sentiment collapsed

Bybit led all platforms with $354M in liquidations, followed by Binance and OKX.

The turmoil comes as Musk publicly threatened to withdraw SpaceX cooperation with federal programs following Trump’s comments on his proposed “Big, Beautiful Bill.” Trump’s camp retaliated with sharp accusations, sparking political tensions that rattled already-leveraged markets.

“Any sudden macro or political spark can detonate highly leveraged crypto structures,” said one derivatives trader. “The Trump-Musk feud acted like a flash grenade.”

Analysts warn that funding rates are starting to normalize, but on-chain metrics suggest the market remains cautious. Meanwhile, whale wallets appear to be buying the dip, possibly anticipating a rebound after the forced shakeout.

For now, the message to traders is clear: in high-leverage markets, politics can move prices just as fast as policy.