Chainlink (LINK) has fallen nearly 28% from its August highs amid broad crypto market weakness, but technical indicators suggest buyers are defending the $20 support level, hinting at a potential recovery.

LINK, the native token of the Chainlink oracle network, dipped briefly below $20 multiple times overnight from Thursday to Friday. The token declined roughly 4% over the past 24 hours, reaching $19.95 before rebounding to $20.26, marking its weakest price since early August.

The pullback occurred despite ongoing buying activity. Wealth management firm Caliber (CWD) added $4 million in LINK tokens to its digital asset treasury strategy on Thursday, bringing its total holdings to $10 million. Meanwhile, the Chainlink Reserve, a facility that purchases LINK using protocol integration revenues, acquired nearly 47,903 tokens (~$1 million) on the same day. Since its August launch, the reserve has accumulated over 370,000 LINK ($7.5 million).

Technical Outlook

- Price Action: LINK retreated 5% from $21.16 to $19.95 before rebounding, showing substantial intraday volatility.

- Support: Strong support exists at the $19.95–$20.00 range, which has been successfully defended multiple times.

- Resistance: Immediate resistance is around $20.30–$20.35, with a key cluster at $20.57 for confirming a trend shift.

- Momentum: A measured bullish move is forming, suggesting potential for sustained upward momentum if buyers push past resistance.

Market Context

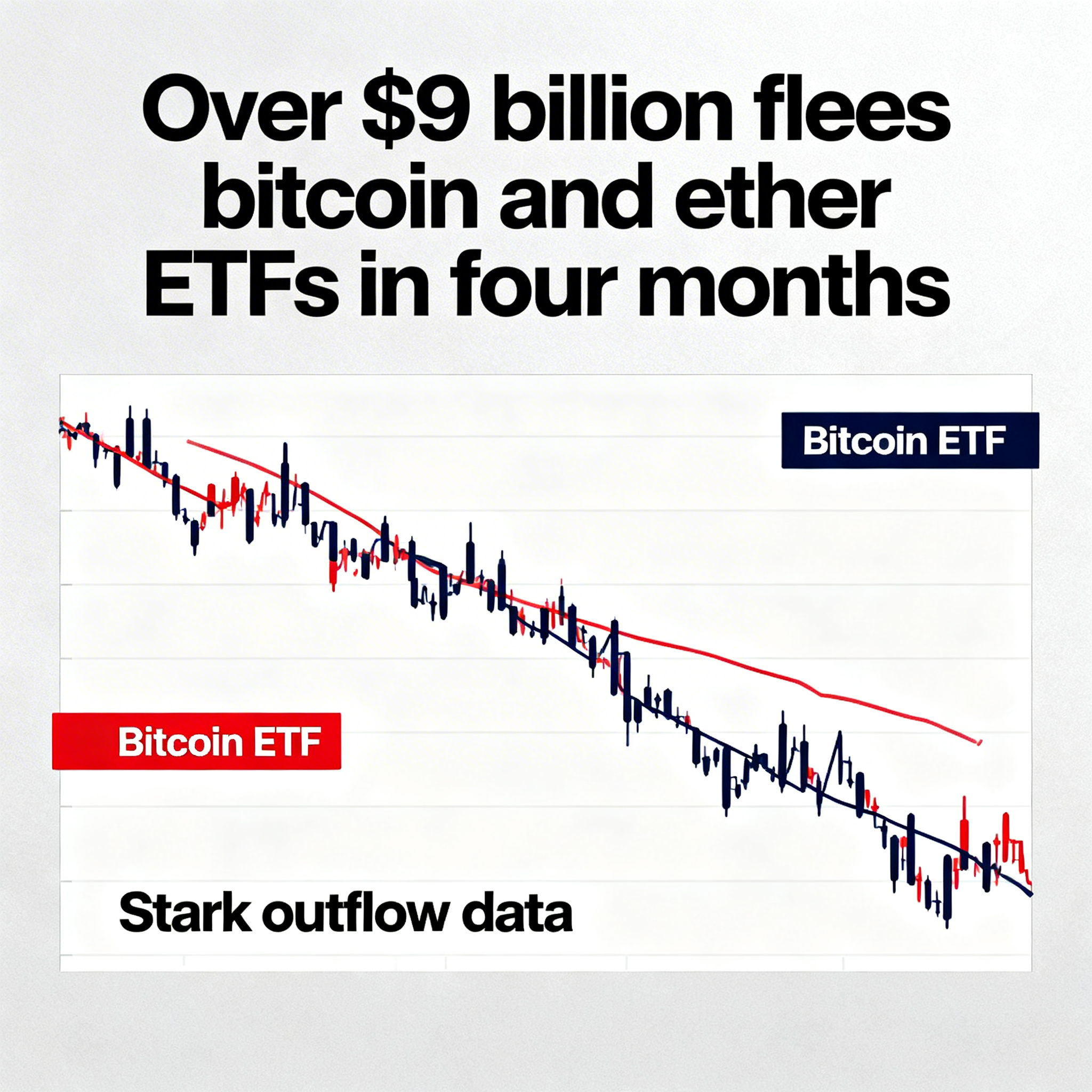

- Macro Factors: Broader cryptocurrency volatility reflected risk-off sentiment as Bitcoin dipped below $109,000, pulling major altcoins lower.

- Micro Factors: High trading volume—over 5 million LINK during the selloff—points to institutional participation, while subsequent recovery activity indicates strong underlying demand for the token.

Overall, LINK remains in a bearish short-term trend, but defending the $20 level and accumulating institutional interest could set the stage for a potential trend reversal if the $20.57 resistance is breached.