Institutional appetite for CME’s XRP futures is fueling renewed expectations for a U.S.-based spot XRP ETF as the token gains further acceptance in regulated environments.

Trading data shows that XRP futures on the Chicago Mercantile Exchange (CME) generated more than $19 million in notional volume on their debut day, followed by an additional $10 million on Tuesday.

The first transaction—a block trade—was executed by Hidden Road on May 18. CME’s XRP futures come in two formats: standard contracts representing 50,000 XRP and micro contracts representing 2,500 XRP. Both are cash-settled and indexed to the CME CF XRP-Dollar Reference Rate, published daily at 15:00 UTC.

On Monday, standard contracts traded 7.5 million XRP, with 2.95 million XRP changing hands on Tuesday. Micro contracts saw volumes of 517,000 XRP and at least 1.2 million XRP on Monday and Tuesday, respectively.

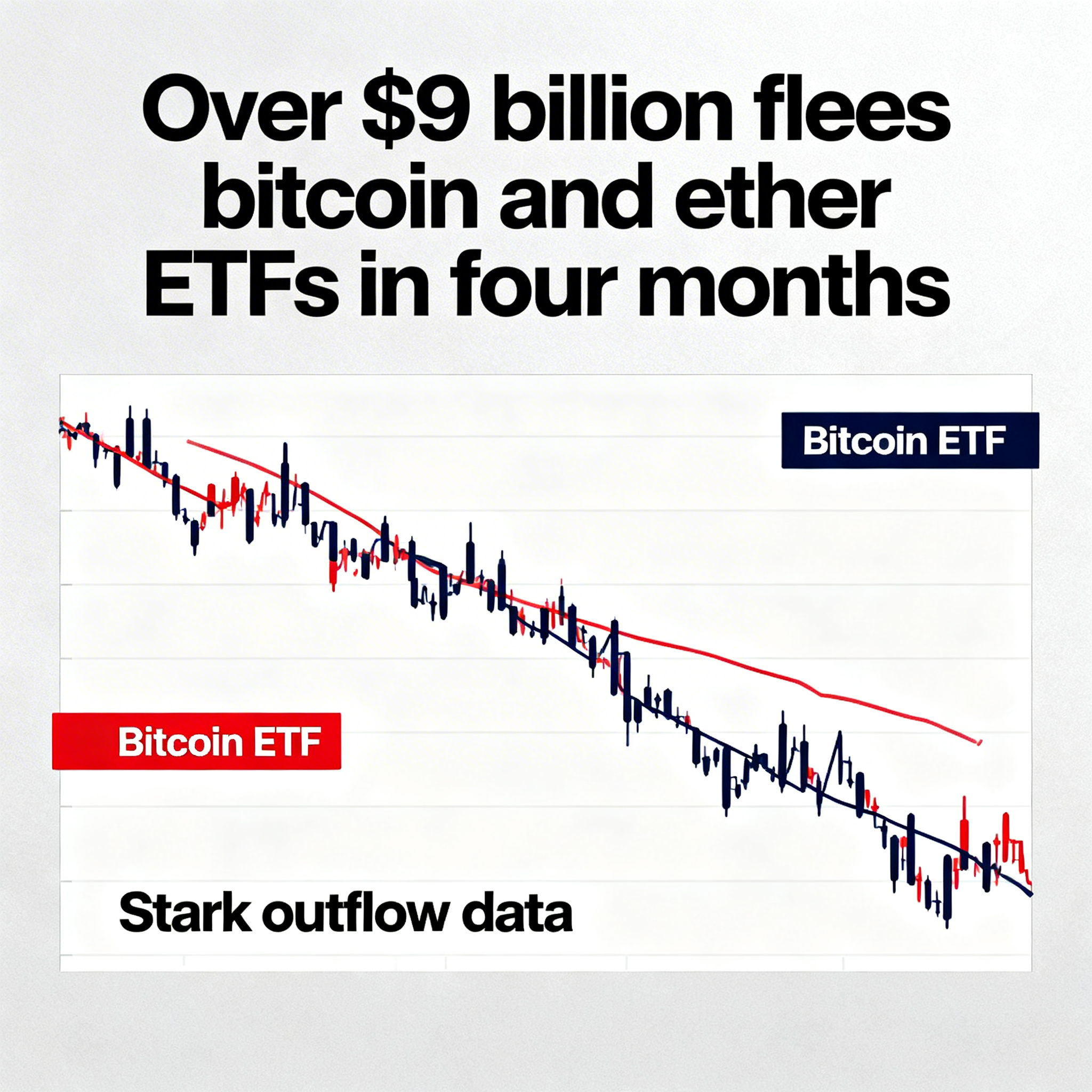

Market watchers interpret the strong debut of these regulated futures as an important step toward potential SEC approval of a spot XRP ETF.

“Spot XRP ETFs are just around the corner,” said Nate Geraci, President of the ETF Store, in a social media comment.

Despite the heightened futures activity, XRP’s spot price held steady near $2.38, edging up 0.42% over the previous 24 hours.