Bitcoin’s price took only a minor hit Friday, but the same couldn’t be said for companies with heavy bitcoin exposure, which saw steep losses as investor concerns about balance-sheet strategies began to resurface.

Shares of bitcoin-heavy firms Strategy (MSTR) and Semler Scientific (SMLR) dropped roughly 6%, while Japan’s Metaplanet plunged 24%, marking one of the worst days for crypto-related stocks in recent months. This came even as bitcoin (BTC) dipped a modest 2%, pulling back to around $109,583.

Despite BTC posting a fresh all-time high earlier in the week, MSTR shares are now trading more than 30% below their 2024 peak. The divergence is fueling renewed skepticism about the sustainability of corporate bitcoin accumulation strategies that rely on investor premiums and financial engineering.

Social media, particularly X (formerly Twitter), lit up with debates over the risks posed by companies accumulating bitcoin via debt and equity issuance. One post by prominent user lowstrife sparked conversation, calling out the trend: “Bitcoin treasury companies are the fad this week… MSTR, Metaplanet, Twenty One. I think their toxic leverage is the worst thing that’s ever happened to bitcoin.”

At the heart of the concern is the market-to-net asset value ratio (mNAV). As long as a company’s market cap exceeds the value of its bitcoin holdings, it can justify issuing shares and buying more BTC. But when that ratio falls below 1.0, it suggests the market values the firm less than the BTC it holds—raising red flags about sustainability, capital access, and the potential for defaults on obligations like convertible bonds or preferred shares.

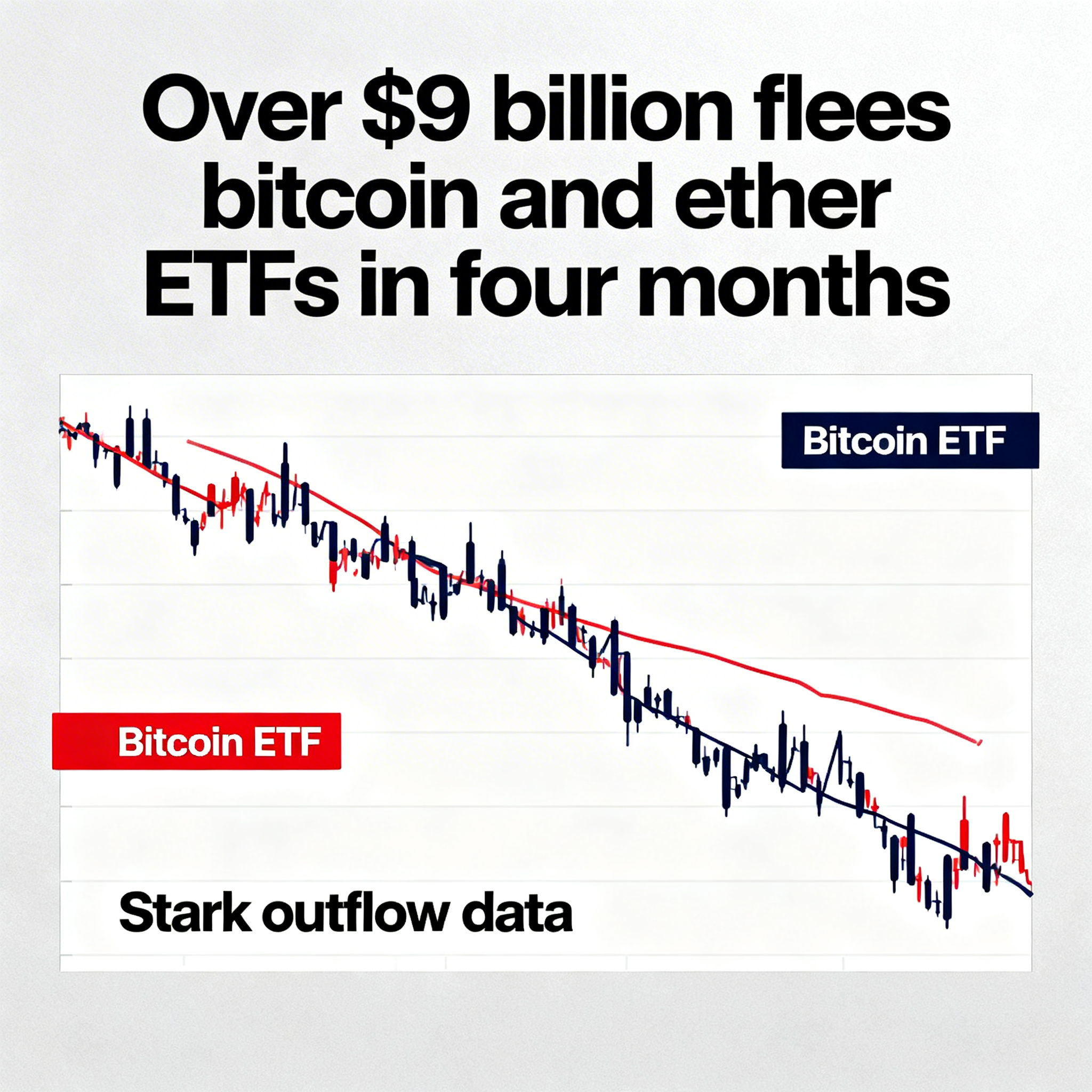

Echoes of GBTC’s Past

Critics are drawing comparisons to the now-defunct GBTC premium era, where Grayscale’s Bitcoin Trust once traded well above its underlying BTC value—until the bubble popped. That reversal helped trigger a chain reaction that brought down major players like Three Arrows Capital and FTX, and crushed bitcoin from $69K to $15K in just 12 months.

Nic Carter of Castle Island Ventures echoed the sentiment: “The whole game now is watching how many BTC these access vehicles can hoard—and when they’ll be forced to unwind it all.”

Still, some prominent voices defended the strategy. Adam Back, CEO of Blockstream, responded: “If mNAV dips below 1.0, firms can simply sell BTC and buy back their own shares—boosting BTC per share and benefiting shareholders. That’s a rational strategy.”

For now, the debate rages on—underscoring the delicate balance between innovation and risk as bitcoin becomes a bigger part of public company treasuries.