Bitcoin briefly topped $93,000 on Monday, driving a risk-on mood across markets, though uneven altcoin performance indicates traders remain cautious about a potential short-term pullback.

The cryptocurrency reached an intraday high of $93,350 — its highest level since Dec. 11 — before easing back to around $92,390. Most of the upward move occurred around midnight UTC, coinciding with the reopening of bitcoin futures on the CME, which left a gap between $90,500 and $91,550. Historically, such gaps tend to be filled within a few days, suggesting prices could revisit the lower range later this week.

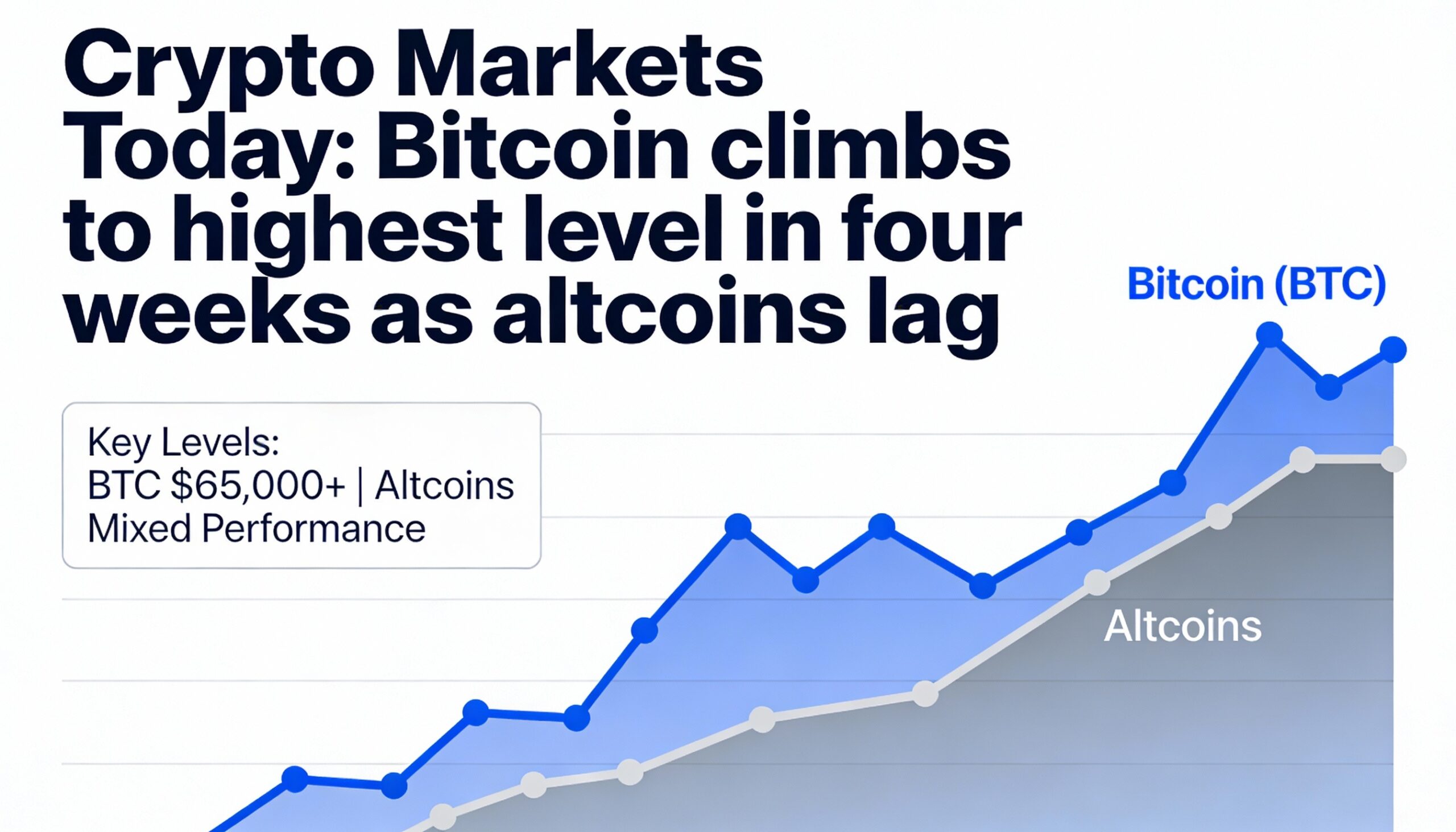

Market focus remains heavily on bitcoin. Since midnight, BTC has gained roughly 1.3%, while altcoin benchmarks lagged: the CoinDesk Meme Index (CDMEME) dropped 6.4% and the Metaverse Index (MTVS) fell 2.3%. Equities and precious metals also moved higher overnight, reflecting a broader risk-on sentiment after recent U.S.-Venezuela developments.

Derivatives positioning

Crypto futures liquidations totaled about $260 million over the past 24 hours, with short positions making up the majority, indicating bearish leverage was caught off guard by the bitcoin rally.

Open interest rose between 2% and 5% in BTC, Bitcoin Cash (BCH), XRP, and BNB, while ETH, SOL, DOGE, and ZEC saw flat or declining open interest, highlighting selective risk appetite. Excluding BTC, BCH, BNB, and XLM, the open interest–adjusted cumulative volume delta for other top-20 coins remained negative, signaling net selling pressure.

BTC perpetual funding rates have climbed above 10% annualized, reflecting strong demand for bullish exposure, while funding rates for many altcoins remain below zero. On Deribit, downside hedging in BTC has weakened as traders increasingly target $100,000 strike calls. Block trades showed put spreads in BTC and call spreads in ETH.

Token highlights

Despite bitcoin’s dominance, some tokens outperformed. Newly launched LIT, the native token of perpetual exchange Lighter, rose 3.9% since midnight, while AI-focused FET extended its weekend rally with a 7.4% gain.

Caution remains, however, as the average crypto relative strength index (RSI) has climbed to 58/100, approaching overbought territory, suggesting short-term profit-taking may be likely.

Several tokens underperformed despite bitcoin’s strength. Zcash (ZEC) slipped 2.5%, while memecoins Dogecoin (DOGE) and Pepe (PEPE) fell 1.4% and 4.5%, respectively.

The mixed performance across altcoins highlights lingering trader indecision and ongoing liquidity constraints, conditions that have pressured the crypto market since October’s liquidation-driven selloff.