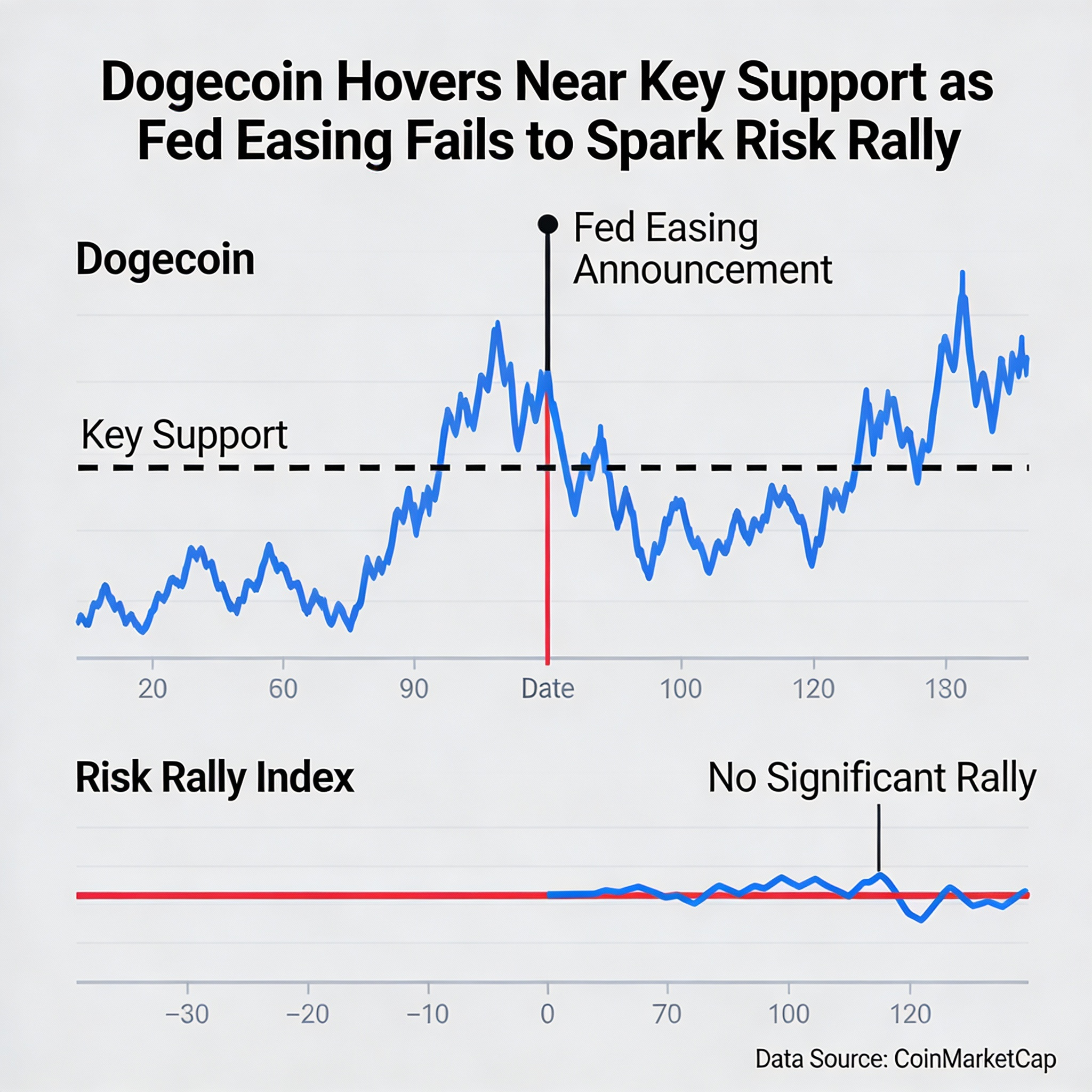

Dogecoin traded with limited direction following the Federal Reserve’s widely anticipated rate cut, holding key support levels as markets weighed whether easier policy would meaningfully revive risk appetite.

News Background

The Federal Reserve cut its benchmark interest rate by 25 basis points on Wednesday, bringing the target range to 3.5%–3.75% and marking the third reduction this year. While the move was expected, policymakers struck a more divided tone, with some officials favoring additional easing to support a softening labor market and others cautioning that further cuts could reignite inflation pressures.

That mixed messaging muted the typical risk-on response, leaving crypto markets largely range-bound rather than extending gains. Against this backdrop, Dogecoin continued to show steady on-chain engagement.

Large holders accumulated an estimated 480 million DOGE in recent sessions, and trading activity remained elevated following the launch of spot Dogecoin ETFs by Grayscale and Bitwise. However, ETF-related flows have yet to translate into sustained directional momentum.

Price Action Summary

DOGE rose 0.69% over the past 24 hours to trade near $0.1405, remaining within its multi-week consolidation range between $0.13 and $0.15. Price fluctuated between $0.1382 and $0.1408 during the session, underscoring restrained participation despite the macro catalyst.

Trading volume reached roughly 651.7 million tokens, about 7% above the seven-day average, suggesting positioning activity rather than aggressive accumulation. Repeated attempts to break above resistance near $0.1425–$0.1430 were rejected, while buyers continued to defend the $0.1380 support zone.

Technical Analysis

From a technical perspective, Dogecoin remains in a compression phase. Horizontal support near $0.1380 has now held through multiple tests, reinforcing its role as a key near-term floor.

Momentum indicators remain neutral, consistent with range-bound conditions rather than trend formation. The broader structure resembles a pennant or volatility coil, implying that a more decisive move is likely to emerge from a breakout or breakdown rather than gradual price drift.

Until price can reclaim the upper boundary of the range, upside attempts are likely to encounter selling pressure.

What Traders Should Know

With the Fed cut now fully priced in and policymakers signaling uncertainty around further easing, Dogecoin appears increasingly sensitive to broader risk sentiment rather than token-specific developments.

Holding above $0.1380 keeps the current structure intact, but repeated failures to reclaim the $0.1420–$0.1450 zone suggest upside remains capped for now. A sustained break above that area would open the door toward $0.16–$0.18, while a loss of $0.1380 would expose the lower end of the range near $0.13.

For now, Dogecoin remains a consolidation trade in a post-Fed, wait-and-see environment.