Bitcoin Hashrate Drops Amid U.S. Winter Storm, Highlighting Centralization Risks

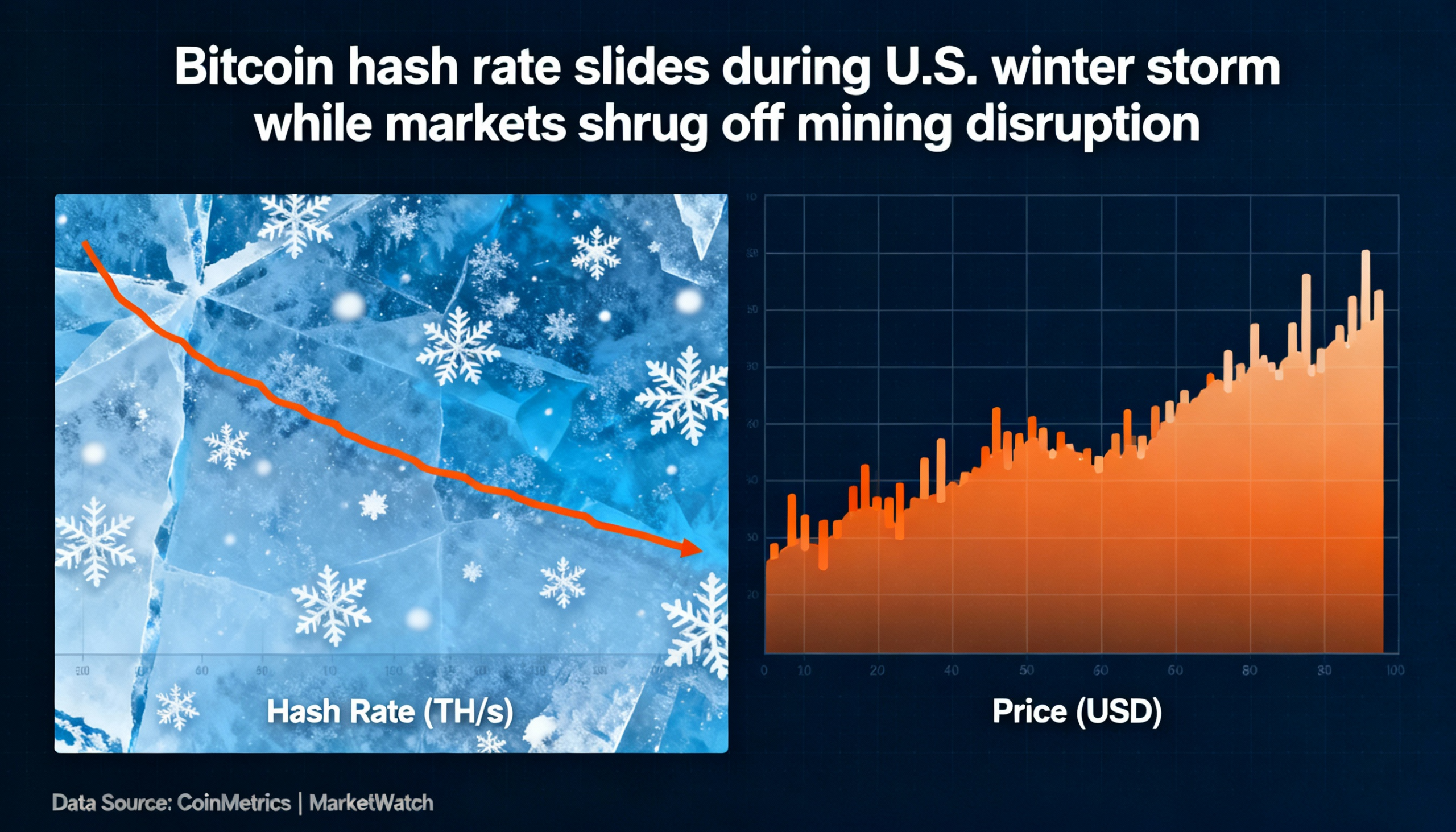

Bitcoin’s hashrate fell about 10% on Sunday during a U.S. winter storm, underscoring concerns over mining centralization—even as markets showed little immediate reaction. The dip serves as a real-world test of a risk long flagged by researchers: concentrated mining can turn local infrastructure failures into network-wide stress.

Hashrate measures the computing power securing the Bitcoin blockchain. Sharp declines reduce transaction-processing capacity until difficulty adjusts. While only around 10% of the network went offline, the event highlights the blockchain’s growing vulnerability to concentrated mining.

Academic research illustrates the potential impact. In the 2021 paper Bitcoin Blackout: Proof-of-Work and the Risks of Mining Centralization, a regional mining outage in China led to slower block times, higher fees, and lower market quality, showing how concentrated mining can magnify local disruptions.

Mining concentration has increased over time. The top two pools often control over 50% of hashrate, while the top six account for 80–90% of all blocks. The winter storm highlights how a few dominant operators can turn local disruptions into broader network stress, even if BTC’s price remains stable.