Bitcoin and Major Cryptos Kick Off 2026 with Strong Gains

Bitcoin (BTC $91,607) and the wider crypto market have started 2026 on a high note, driven by new-year allocations, safe-haven demand, and early institutional inflows.

Market Performance

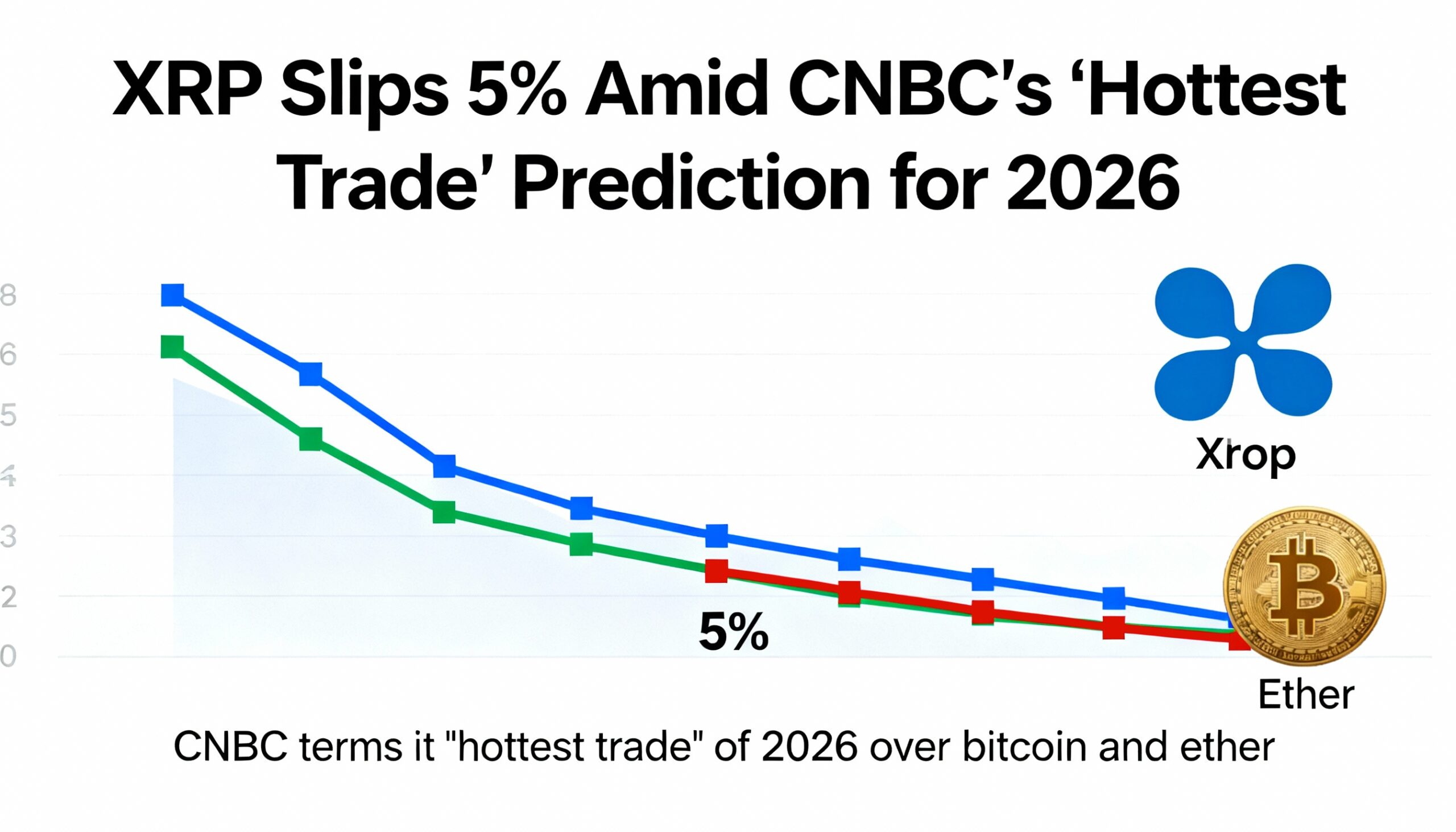

Bitcoin traded near $93,700 on Tuesday, up about 1% over 24 hours and more than 7% since January 1. Ether (ETH $3,197) gained nearly 2% to $3,224, rising roughly 9% week-to-date. Among large-cap altcoins, XRP (XRP $2.24) led the charge with a 13% one-day jump to $2.40 — up nearly 29% over the week. Solana (SOL $136.82) rose 12%, while Dogecoin (DOGE $0.1483) gained 23% in the past seven days.

Fading Tax Pressure

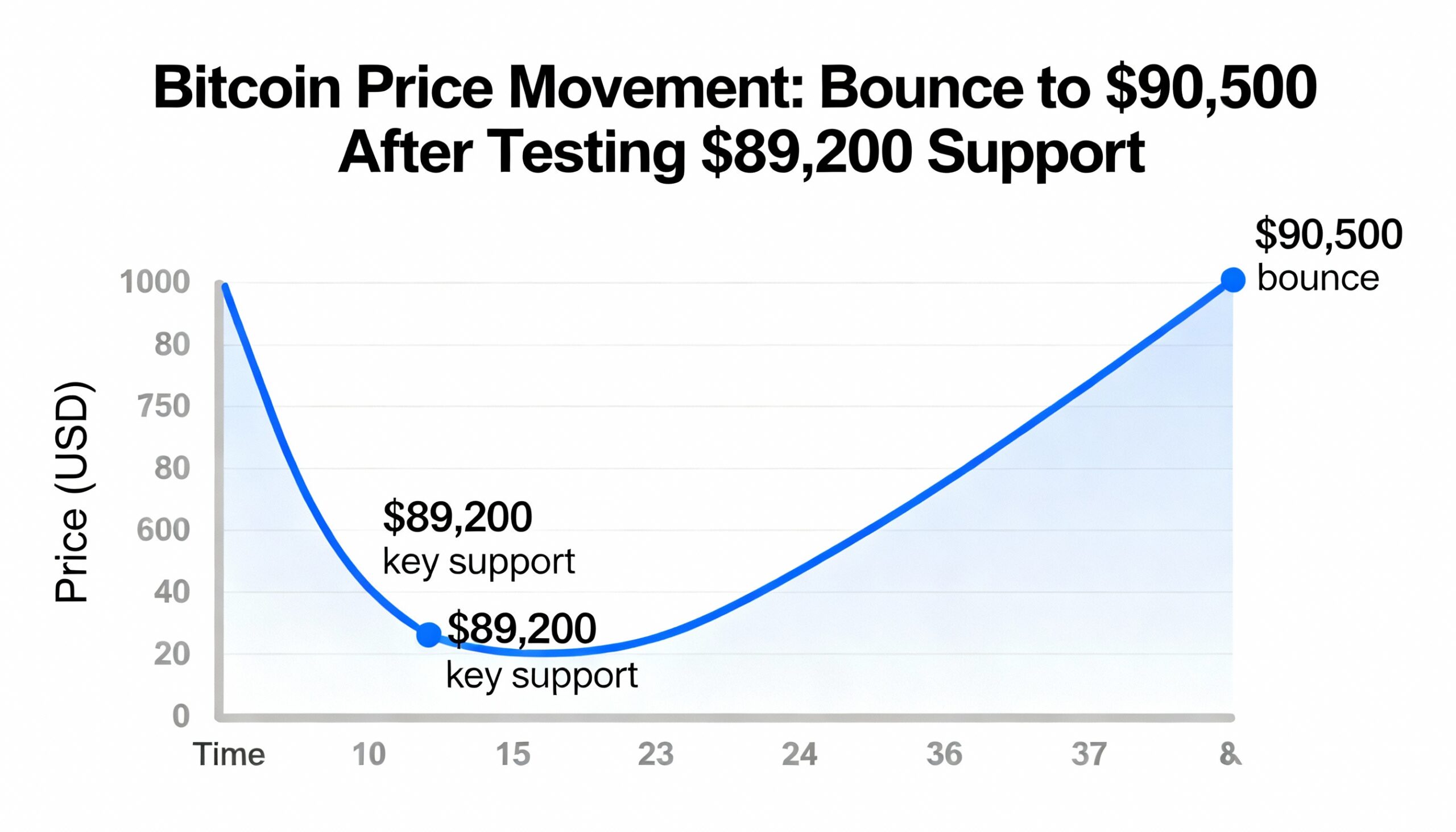

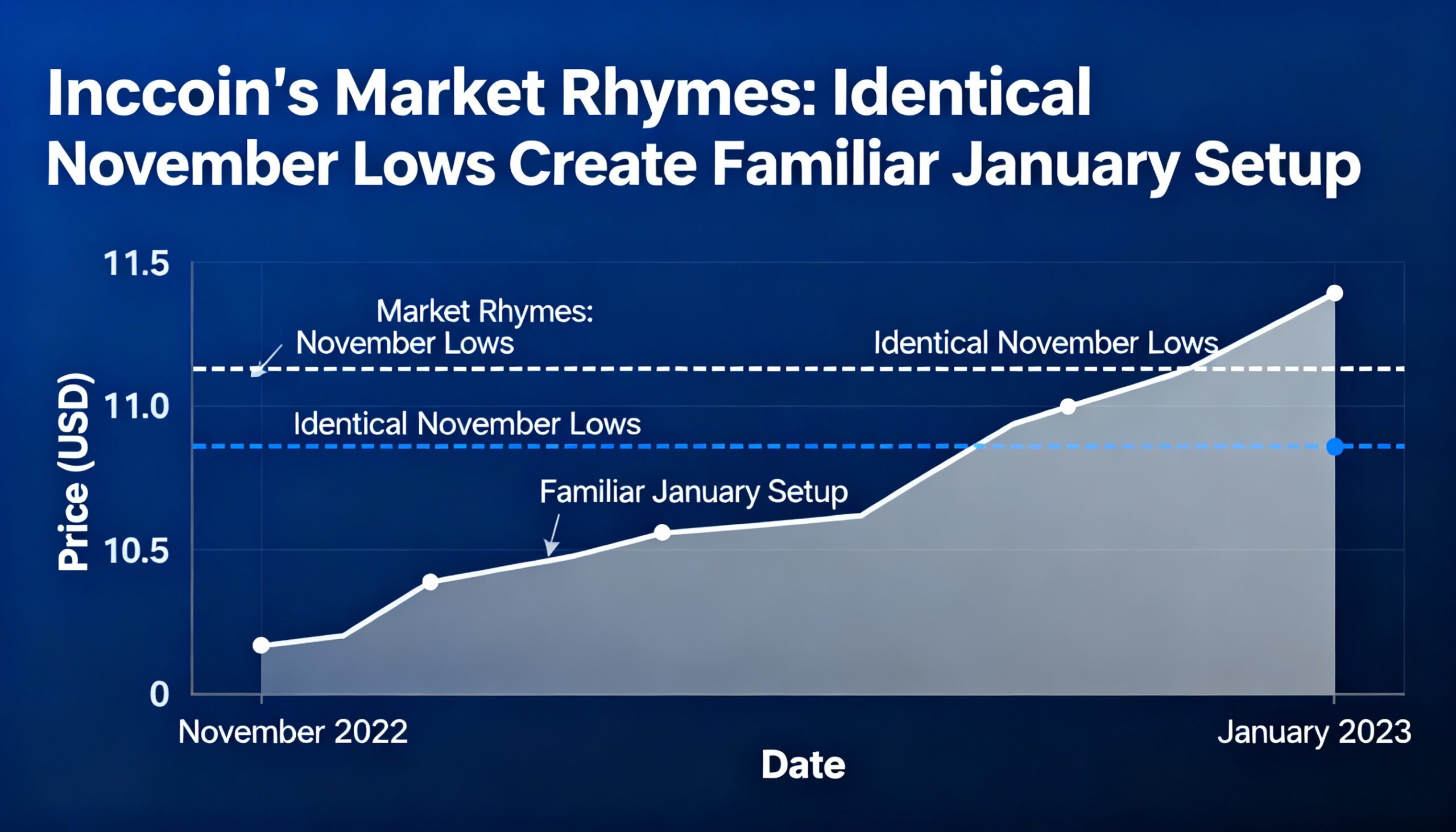

The late-December market weakness was driven by U.S. tax-loss selling and year-end portfolio adjustments. With that pressure now easing, analysts see room for a rebound.

“Crypto’s alignment with broader risk assets reflects more than a coincidence — it signals a regime shift to start the year, supported by the fading of tax-loss harvesting and renewed policy optionality,” said Singapore-based QCP Capital.

Safe-Haven Demand and Geopolitical Drivers

Monday’s U.S. military action in Venezuela helped spur safe-haven flows into Bitcoin and gold. Speculation that Venezuela’s oil supply could increase under U.S. guidance may be creating disinflationary expectations, potentially supporting lower interest rates.

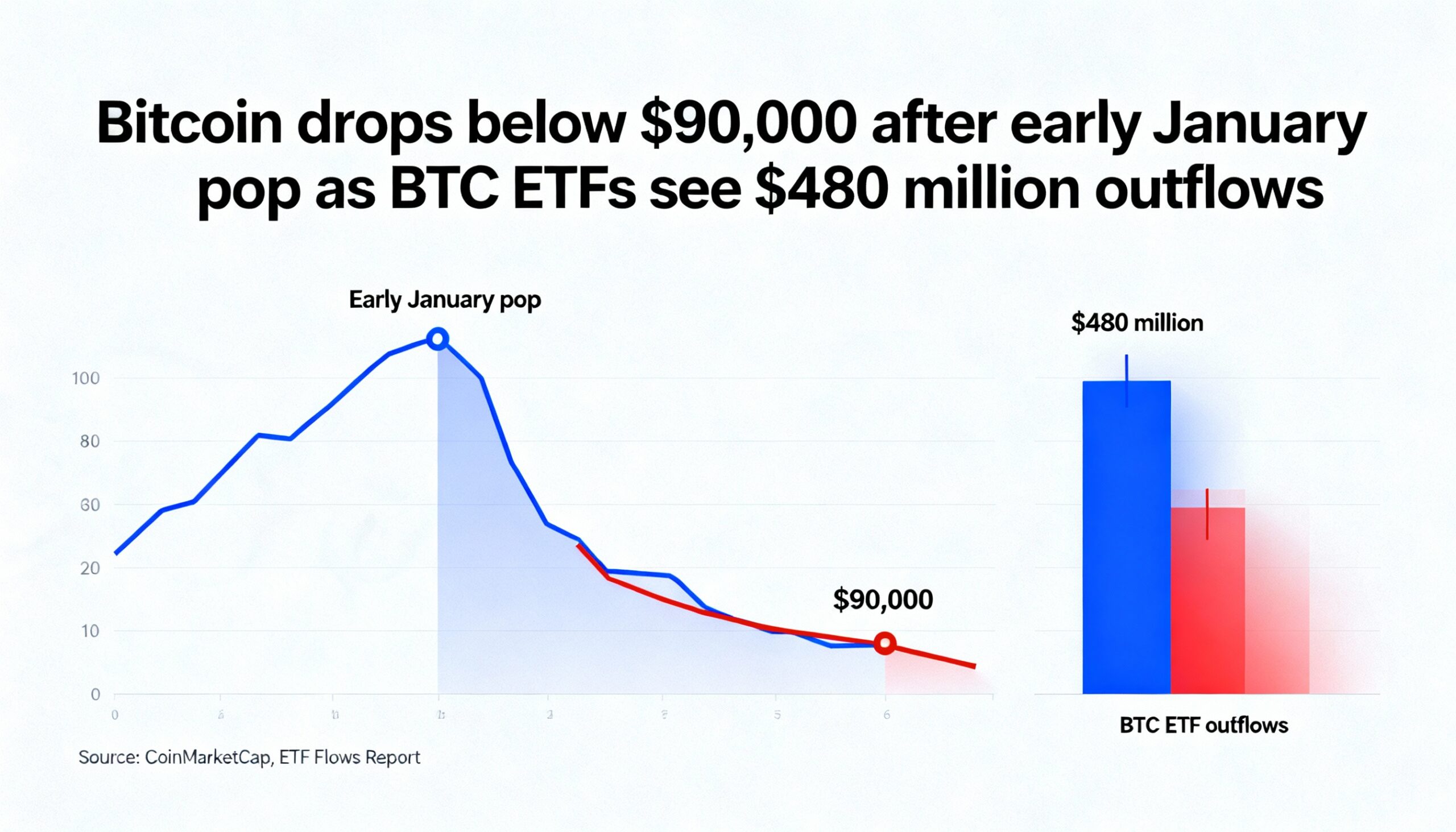

Institutional Flows and Options Activity

U.S.-listed spot ETFs began 2026 with strong inflows, reversing a two-month de-risking trend. Eleven funds collectively added over $1 billion in the first two trading days, helping stabilize thin holiday liquidity. Options data from Deribit shows traders targeting $100,000 calls for Bitcoin and $3,200–$3,400 calls for Ether, betting on further near-term gains.

Liquidity Concerns Remain

Despite the strong start, spot market liquidity remains thin, making prices sensitive to large orders. Vikram Subburaj, CEO of Giottus exchange, noted that while momentum is constructive, shallow order books increase the risk of abrupt pullbacks. ETF inflows and desk activity provide support, but broad-based conviction is still developing.