XRP continues to trade under pressure, unable to reclaim the heavily defended $2.23–$2.24 resistance band as broader crypto sentiment remains firmly bearish.

The token endured aggressive selling at multiple support levels before staging a sharp, high-volume V-shaped rebound — a move that suggests short-term sellers may be losing momentum. Still, the recovery unfolds against a backdrop of mixed institutional flows and rising macro uncertainty. Crypto markets remain stuck in a medium-term downtrend, with fear-driven sentiment and elevated volatility across major assets.

Canary Capital’s newly launched U.S. spot XRP ETF (XRPC) posted a surprisingly strong debut, generating $58.6 million in first-day trading volume — more than triple the $17 million analysts expected. Yet the enthusiasm failed to stabilize XRP. Stress signals surfaced in derivatives markets, where roughly $28 million in liquidations hit within 24 hours, including nearly $25 million wiped from long positions alone.

Analysts say the conflicting institutional picture — ETF inflows on one hand and persistent risk-off pressure on the other — continues to weigh on liquidity and suppress momentum across crypto.

Price Action Overview

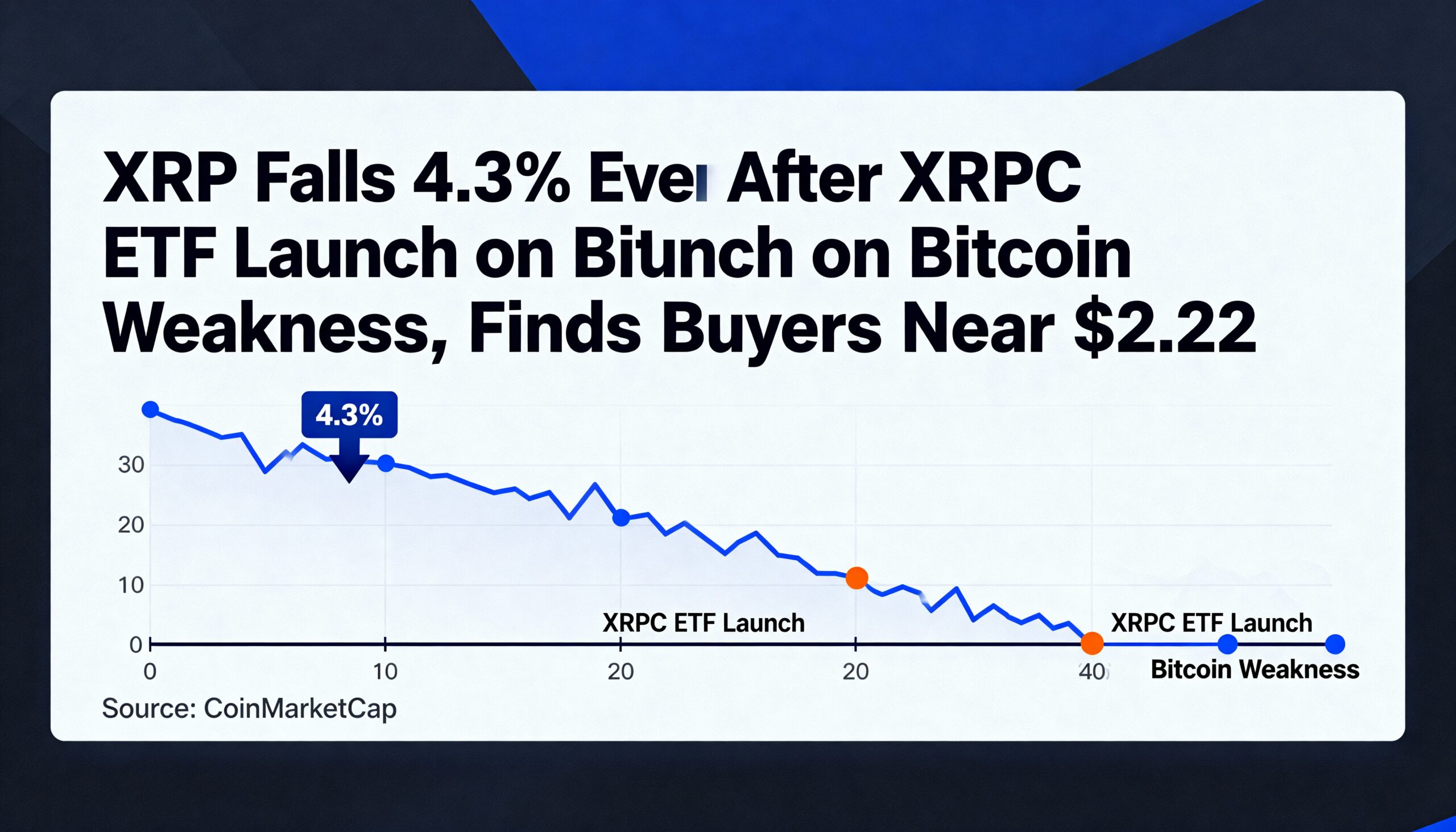

XRP fell 4.3% from $2.31 to $2.22 during the session ending Nov. 16 at 02:00 UTC, carving out a $0.10 intraday range and printing a clean sequence of lower highs. The sharpest sell pressure arrived at 00:00 UTC, when 74 million XRP traded — 69% above the 24-hour average — breaking the $2.24 support and driving price to the session low of $2.22. Three separate volume surges above 57 million reinforced sustained distribution during the decline.

Despite the ETF catalyst, XRP’s selloff accelerated after a rejection at $2.31, with no meaningful support emerging at previous consolidation zones. After the breakdown, price stabilized into a narrow $2.22–$2.23 consolidation channel.

Technical Picture

Support and Resistance

- Primary support: $2.22 (capitulation low)

- Immediate resistance: $2.23–$2.24 (breakdown zone)

- Key Fibonacci support: $2.16 (0.382 retracement); losing this level could trigger a swift move toward $2.02–$1.88

Volume Dynamics

- Breakdown volume: 74M XRP (+69%), confirming a capitulation-style flush

- Two reversal spikes: 4.7M XRP each (01:39, 01:46 UTC), indicating seller exhaustion

- Recovery volume: Normalized but consistent, suggesting bottom-fishing demand

Market Structure

- Overnight trading hammered XRP into support before a classic V-shaped reversal formed

- Higher lows developed at $2.209 → $2.217 → $2.227, hinting at a short-term momentum shift

- The broader downtrend from $2.31 remains intact

- Failure to reclaim $2.23–$2.24 continues to cap upside potential

Momentum Indicators

- Intraday oversold readings helped trigger the rebound

- The daily trend remains bearish, with both the 50D and 200D averages sloping downward

What Traders Should Watch

XRP now sits at a critical short-term inflection point:

- Holding $2.22 is essential — a breakdown risks a direct slide to $2.16, then $2.02–$1.88

- Reclaiming $2.24 and then $2.31 is required to neutralize the bearish structure

- XRPC ETF flows may drive additional volatility; monitor U.S. open volumes closely

- The V-shaped rebound offers short-term relief, but major overhead resistance still constrains upside

- Only a decisive move above $2.48 would flip the broader trend back toward $2.60+ targets