Bitcoin slips as investors favor gold and silver ahead of Fed and tech earnings

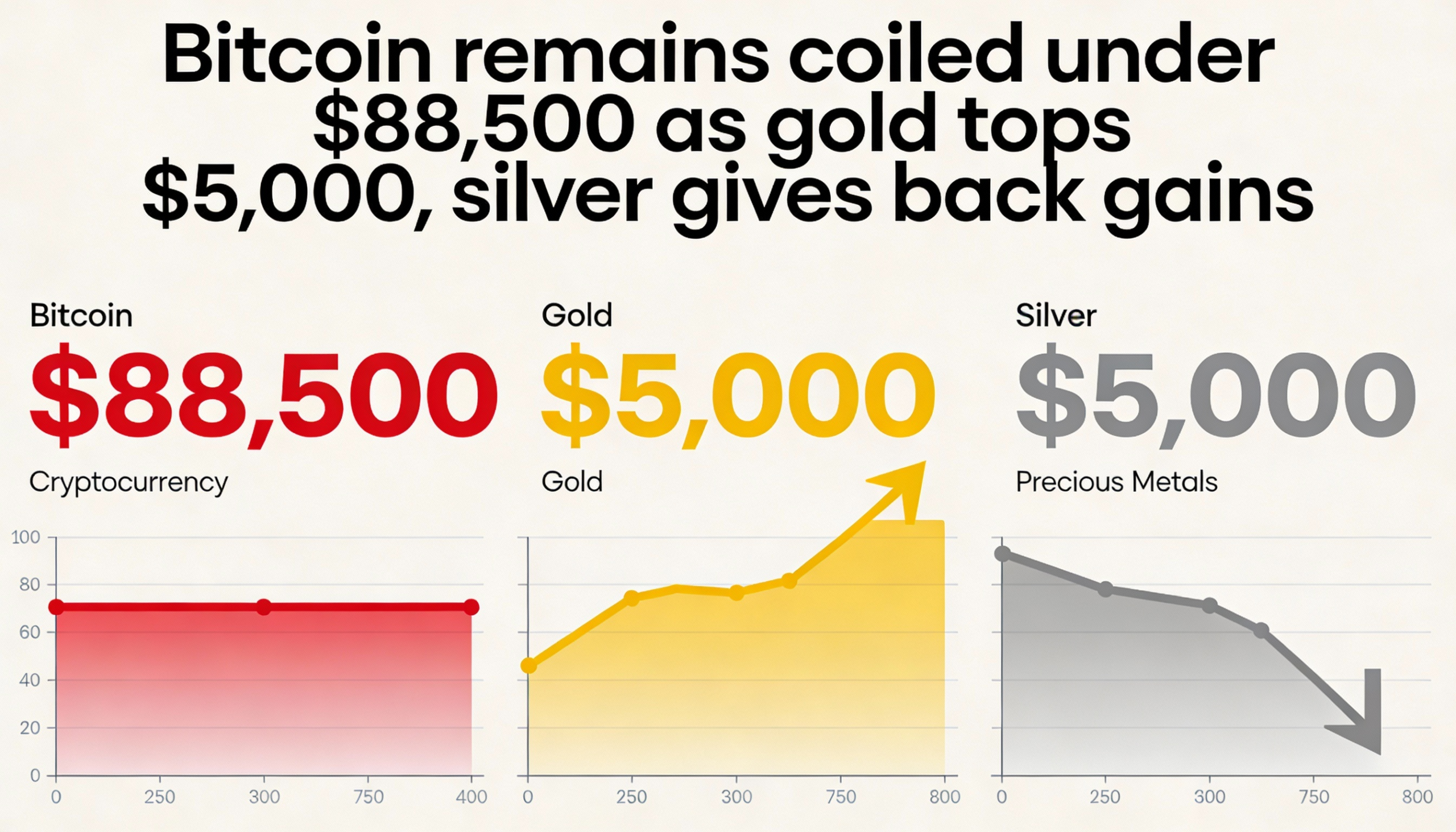

Bitcoin remained below $88,500 early this week, along with most major cryptocurrencies, as investors rotated into gold and silver ahead of key events for global markets, including the Federal Reserve’s policy decision and a busy week of Big Tech earnings.

BTC traded around $88,400 during Asian hours, modestly down on the day and roughly 4% lower over the past week, according to CoinDesk data. Ether (ETH) hovered near $2,940, while Solana (SOL) at $125.87, XRP at $1.91, and Dogecoin (DOGE) at $0.1244 also posted small declines, reflecting a cautious tone across crypto markets.

Precious metals led the macro moves. Silver retraced slightly after its sharpest daily gain since 2008, while gold briefly topped $5,000 an ounce before easing back. Even with the pullback, silver finished Monday up 0.6% following a 14% intraday spike—the largest one-day swing since the global financial crisis—highlighting strong demand amid market uncertainty.

By contrast, cryptocurrencies have struggled to follow broader macro trends. Bitcoin remains well below its October peak despite falling real yields, a softer dollar, and rising geopolitical uncertainty boosting equities and precious metals. “Cryptocurrencies remain a lagging class of risk-sensitive assets, underperforming metals and the strongest global currencies,” said Alex Kuptsikevich, chief market analyst at FxPro. He added that BTC remains below key moving averages and has yet to challenge support levels from the past two months.

Looking ahead, the Federal Reserve is widely expected to hold rates steady at Wednesday’s policy meeting, while earnings from several Magnificent Seven companies will test whether the AI-driven equity rally can continue. Both events could influence investor risk appetite and set the tone for crypto markets.

For now, bitcoin remains range-bound near $88,400, drifting lower as traders await clearer signals from Fed guidance and Big Tech results.