Gold and other hard assets are rallying as the dollar weakens, but bitcoin remains muted, reflecting its status as a liquidity-sensitive risk asset rather than a traditional hedge.

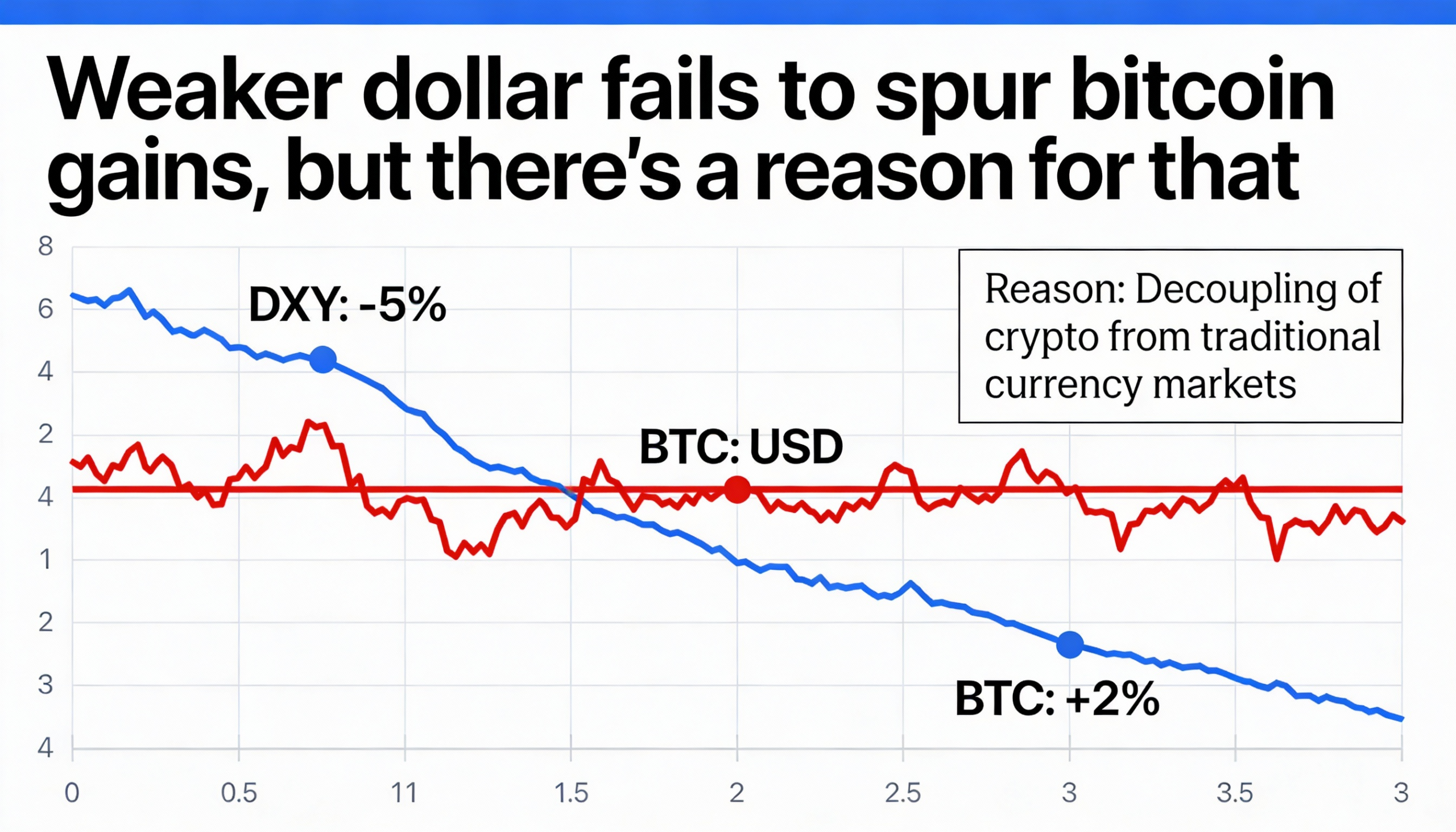

The Dollar Index (DXY) has dropped roughly 10% over the past year. Historically, BTC tends to rise alongside a weaker dollar, yet bitcoin has fallen 13% in the same period, while the broader CoinDesk 20 index (CD20) declined 28%, according to CoinDesk data.

J.P. Morgan Private Bank says the difference this time lies in the nature of the dollar’s slide. “The recent dollar decline isn’t about growth or monetary policy changes,” said Yuxuan Tang, the bank’s head of macro strategy in Asia. “Interest rate differentials have actually moved in the USD’s favor since the start of the year. What we’re seeing now, much like last April, is a USD selloff driven primarily by flows and sentiment.”

The bank expects the dollar’s weakness to be temporary, stabilizing as the U.S. economy picks up. Gold and other hard assets have benefited from the decline, while bitcoin remains range-bound, suggesting the crypto market does not view this as a durable macro shift.

Without a clear change in growth or monetary policy expectations, dollar weakness alone has not been enough to pull fresh capital into crypto markets. J.P. Morgan recommends gold and emerging-market assets as more direct beneficiaries of dollar diversification, leaving bitcoin to behave like a high-beta risk asset.