U.S. Debt Tops $36T, but Strong 10-Year Treasury Auction Signals Investors Aren’t Fleeing Yet

Despite mounting fears over America’s ballooning fiscal deficit, demand for U.S. government debt remains resilient — at least for now.

At Wednesday’s auction, $39 billion in 10-year Treasury notes were snapped up by investors with a bid-to-cover ratio exceeding 2.5x, a sign of robust appetite. Yields settled at 4.421%, and the primary dealer takedown — a measure of how much debt banks are forced to absorb when other buyers step back — came in at just 9%, the fourth-lowest on record, according to Exante Data.

This comes as Washington’s total debt load crosses the $36 trillion mark, now more than 120% of GDP, renewing long-term concerns over fiscal sustainability. The U.S. ran a $1.8 trillion deficit in 2024, and projections suggest an additional $2.4 trillion gap may emerge in the coming years, driven by President Donald Trump’s tax cut plans and increased debt servicing costs — now approaching $1 trillion annually.

Markets Watching Thursday’s 30-Year Bond Sale

Next up: a $22 billion 30-year bond auction on Thursday, which may offer a clearer window into investor confidence — or caution — about long-duration exposure to U.S. debt amid volatile macro conditions and the geopolitical aftershocks of Trump’s revived trade war initiatives.

While the 10-year results appear to defy the narrative that global capital is rotating out of Treasuries and into hard assets, analysts say the longer end of the curve may tell a different story.

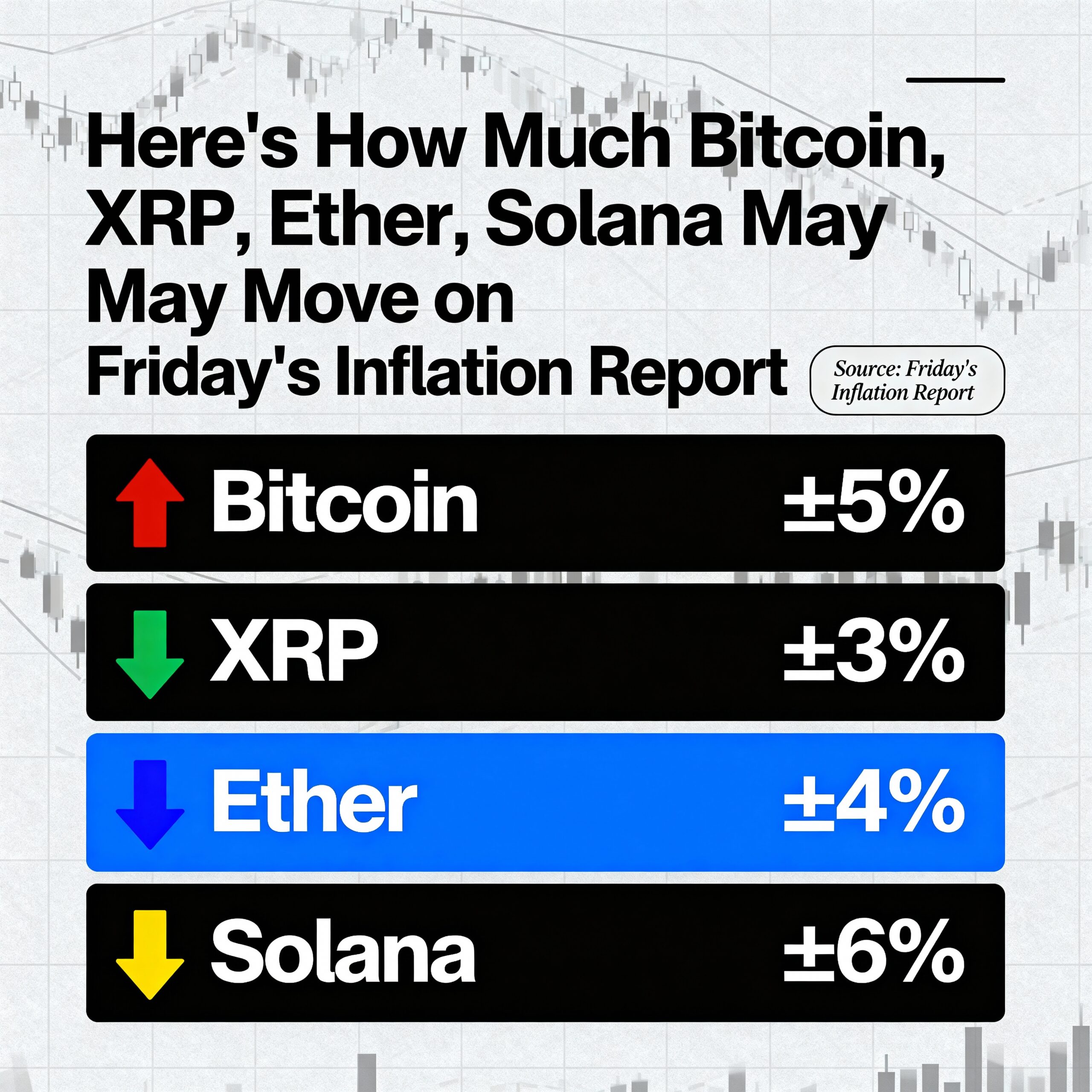

Bitcoin and Gold Back in the Spotlight

As the fiscal outlook darkens, some analysts are once again pointing to bitcoin and gold as potential hedges against sovereign debt risk. With debt servicing costs climbing and monetary policy options narrowing, hard assets may serve as insurance against fiscal slippage and long-term currency debasement.

Though this week’s auction calmed immediate fears, investors are keenly aware: structural cracks remain. And if confidence in U.S. fiscal credibility falters further, risk-off flows may not stop at government bonds — they may accelerate into non-sovereign stores of value.