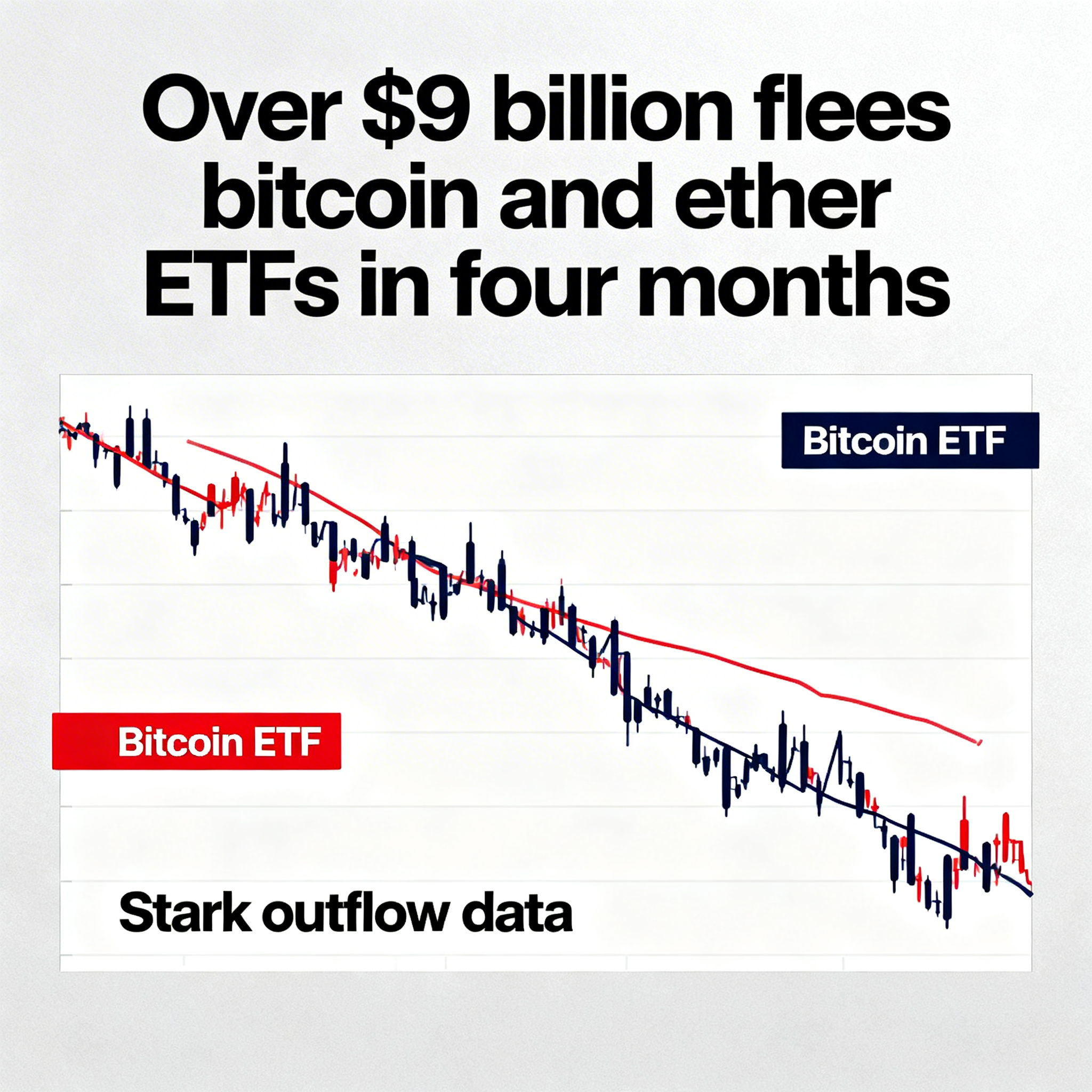

Bitcoin Encounters Critical Resistance Above $88K — Will the Uptrend Continue?

Bitcoin’s ongoing rally has now run into substantial resistance just above the $88,000 level, presenting a key moment in determining the future direction of the market.

The first major obstacle is the 200-day simple moving average (SMA), which currently sits at $88,356. As a widely respected indicator of long-term market momentum, the SMA serves as a key benchmark. Bitcoin’s recent fall below this level in March prompted some analysts to suggest that the crypto market may be entering a correction phase, as noted by Coinbase’s institutional team.

For the rally to stay on track, Bitcoin will need to break above this resistance level and maintain upward momentum. A move above the 200-day SMA would indicate that the bullish trend is gaining strength.

In addition to the SMA, the Ichimoku Cloud adds another layer of resistance. This technical analysis tool, which identifies market trends, support, and resistance, has its upper boundary near the 200-day SMA. A breakout above the Ichimoku Cloud would signal a continuation of the bullish trend. The Ichimoku Cloud consists of five key components, including Leading Span A, Leading Span B, Conversion Line (Tenkan-Sen), Base Line (Kijun-Sen), and a lagging closing price line. When Bitcoin moves above the cloud, it often signals a shift to a more bullish market environment.

Finally, the March 24 high of $88,804 remains another significant resistance point. Bitcoin’s failure to surpass this level in the past led to a sharp correction, pushing the price back down to the $75,000 range.

As Bitcoin faces these multiple resistance levels, the next few days could be critical in determining whether the rally will continue or if the market will experience a pullback. A decisive breakout above these resistance points could set the stage for higher price levels, while a rejection could signal a period of consolidation.