Crypto Pullback Continues as Bitcoin, Ether Slide; Oversold Signals Offer Limited Relief for Altcoins

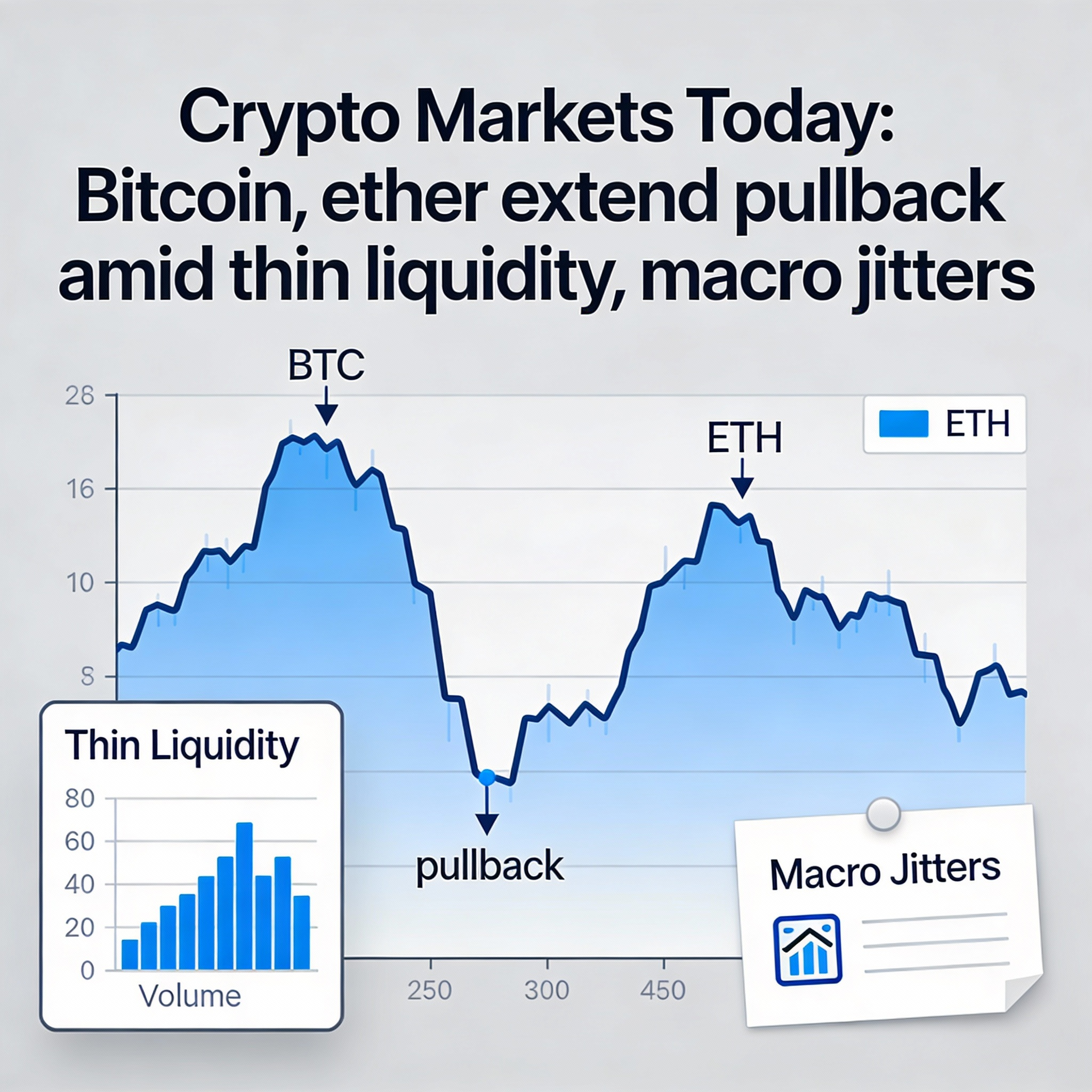

Bitcoin and ether extended losses on Monday, tracking weakness in global equities, while oversold indicators offered a tentative glimmer of hope for battered altcoins.

Bitcoin (BTC$88,535.99) fell roughly 4% to $86,100, and ether slipped below $3,000 after a 6.7% decline over 24 hours. The sell-off dragged the CoinDesk 20 Index down 4.3%, with all constituent tokens lower, mirroring a broader pullback in traditional markets. The Nasdaq Composite fell 2.6% for a second consecutive day, amid concerns about a potential AI bubble and ahead of U.S. labor data, including November nonfarm payrolls, scheduled for release Tuesday.

“Consensus forecasts suggest around 50,000 new hires, less than half the 119,000 seen in September, but the range of expectations is unusually wide,” said Derren Nathan, head of equity research at Hargreaves Lansdown. “If recent private jobs data is anything to go by, the risk is to the downside.”

Liquidity and Derivatives Pressure

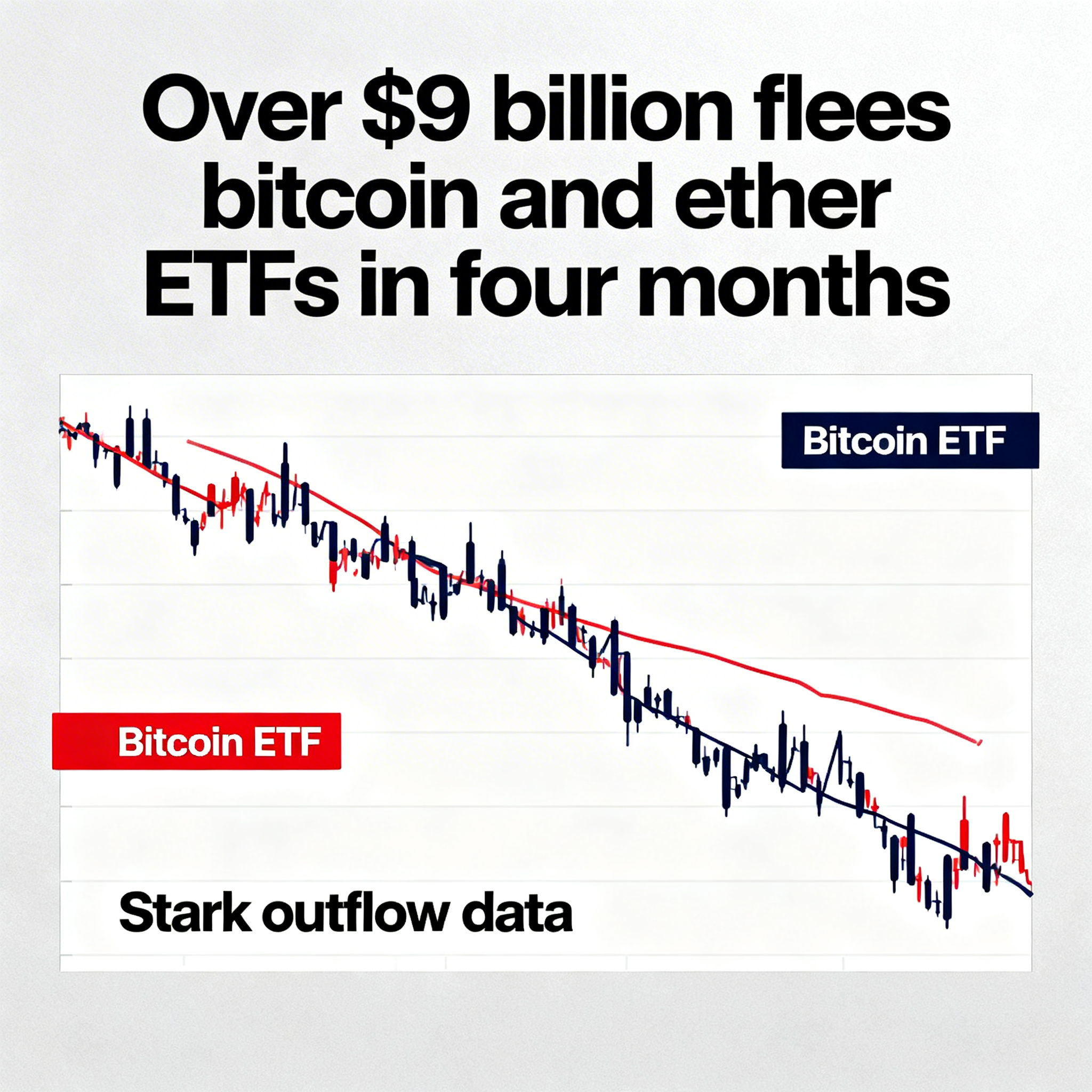

Since October’s market wipeout, crypto has underperformed equities, partly due to thin liquidity amplifying price swings. Derivatives markets show ongoing bearish sentiment:

- Volmex’s one-day BVIV, measuring expected 24-hour price volatility, remains above 50%, implying a 2.6% daily move, typical even ahead of key economic releases.

- Exchanges liquidated over $660 million in leveraged futures within 24 hours, predominantly long positions, removing bullish leverage.

- Global open interest in BTC futures exceeded 700,000 BTC, the highest since November 21, suggesting an influx of bearish positions alongside falling spot prices. XRP futures open interest also rose to 1.96B XRP, the highest since October 11.

- The OI-adjusted cumulative volume delta for major tokens declined, indicating aggressive net selling.

- On Deribit, BTC and ETH put options remain pricier than calls, reflecting continued downside concerns and institutional use of call overwriting strategies. The $85K BTC put has emerged as the second-most traded option behind the $100K call.

- Active derivatives strategies included BTC put diagonal spreads, put ratio spreads, and straddles; ETH traders favored put butterflies.

Altcoins Seek Catalyst

The altcoin market continues to struggle following a two-month corrective phase. Tokens like ASTER, ONDO, and STRK fell more than 10% over 24 hours, underperforming broader crypto trends.

Some optimism comes from oversold conditions, as measured by average crypto RSI readings, suggesting the possibility of a short-term bounce ahead of U.S. employment figures. Key altcoins including XRP, SOL, and ADA are approaching historical support levels that have previously marked local bottoms, potentially offering areas for renewed investor interest.